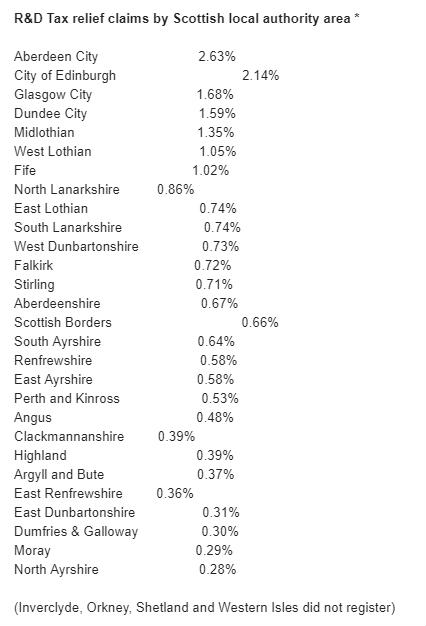

Aberdeen continues to top ‘innovation league table’ for Scottish R&D tax relief claims

Scott Henderson

Aberdeen continues to lead the way as the city with the highest rate of innovative businesses across Scotland’s 32 local authority areas.

A total of 250 Aberdeen companies (2.6 per cent of all enterprises in city), including SMEs and large businesses, claimed for R&D tax relief in the latest 2016-17 figures released today by HMRC.

This puts the Granite City at the top of an Innovation League Table produced by R&D tax relief specialist Jumpstart showing the number of claims being made in relation to the number of enterprises in each Scottish local authority area.

The figures underline the relatively high level innovation within the oil and gas sector which dominates the Aberdeen economy according to Jumpstart.

Edinburgh was second in the table with 2.1 per cent of its businesses making R&D-related tax relief claims. The capital’s strong IT and financial services sectors are cited as driving forces for its continued strong placement. Glasgow (1.7 per cent of businesses making a claim) and Dundee (1.6 per cent) were third and fourth respectively in the table.

The bottom end of the Scottish table includes East Dunbartonshire, Dumfries and Galloway, Moray and North Ayrshire with 0.3 per cent or fewer businesses in those areas securing a claim for R&D tax relief. The figures used to compile the table are rounded up to the nearest five claims, meaning a number of smaller and, in some cases, remote local authority areas including Orkney, Shetland, Inverclyde and the Western Isles did not make the list.

Aberdeen is placed fourth against other UK unitary authority areas in terms of the ratio of businesses securing R&D tax relief claims.

Two Northern Ireland authorities topped the list with Mid-Ulster (3.49 per cent of businesses claiming) and Belfast (2.92 per cent) ranking first and second respectively. Cambridgeshire is third on the table with 2.9 per cent of its businesses securing a R&D tax relief claim.

Scott Henderson, managing director at Jumpstart, said: “Today’s HMRC figures form the basis of our Innovation League Table. It shows Aberdeen businesses once again leading the way in making successful R&D tax relief claims. The city’s oil and gas sector continues to invest in innovation to improve operational processes and enhance competitiveness in the global market place.

“Other key Scottish industry sectors including IT, financial services and biotechnology account for the higher proportion of R&D tax credit claims for Edinburgh, Glasgow and Dundee in this year’s league table.

“It is not surprising to see many rural areas in Scotland ranking further down the list. While many of the industries in these areas, including agribusinesses, are benefitting from innovation and technology this is often being developed externally by supplier companies.

“The HMRC stats show more than £1.4bn in R&D tax relief credits were secured by Scottish companies in the 2016-17 period, underlining the importance of the scheme in supporting businesses which aspire to be world class.”