And finally… ‘Big Short’ protagonist launches UK fund

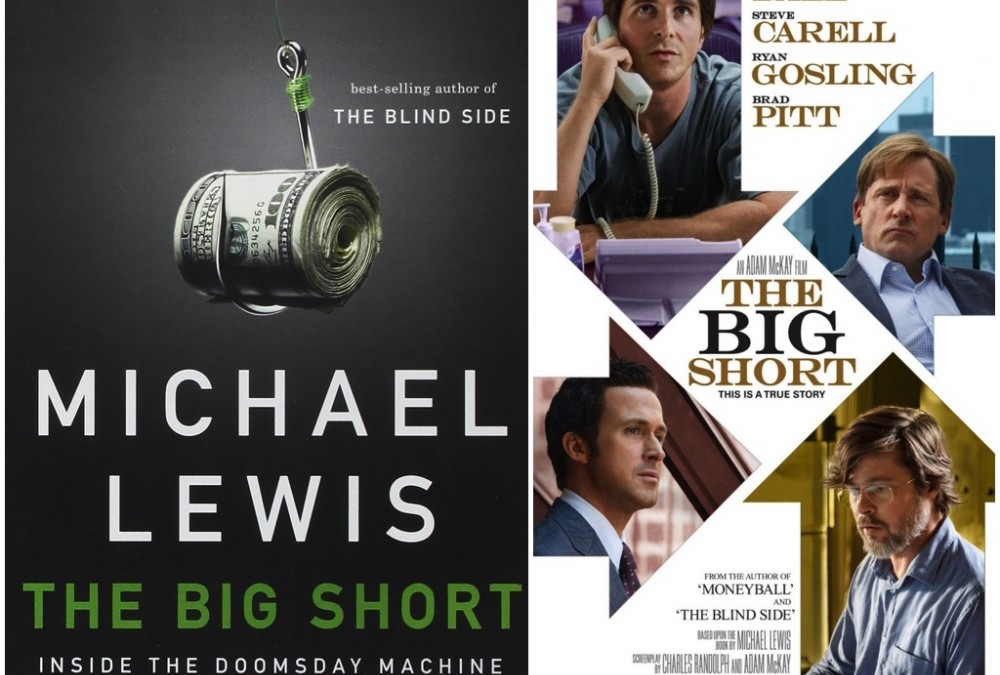

Steve Eisman, the American investor who made a fortune by predicting the sub-prime mortgage crisis that precipitated the global crash of 2008, and portrayed by Hollywood’s Steve Carell in the acclaimed film ‘The Big Short’ depicting his exploits, is setting up shop in the United Kingdom.

Neuberger Berman is launching a UK domiciled fund range with a global long/short portfolio, headed by Eisman.

The TM Neuberger Berman Absolute Alpha fund is a fundamentally-driven global long/short equity strategy, which will take both the long and short positions.

The onshore range will sit alongside the firm’s Irish-domiciled UCITS range, which manages around £2.3bn for UK investors, but it will not fully replicate it. Its aim is to enable UK investors to access the group’s strategies “more efficiently”, the firm said.

Charges on platforms for UK retail investors are 1.24 per cent, with some leading platforms and wealth managers having an introductory rate of 0.65 per cent.

Steve Eisman famously made millions by forseeing the subprime mortgage crisis of 2007 that kicked off the global recession - a story which formed the basis of the plot of 2015 film ‘The Big Short’, in which Eisman was dramatised as Steve Carell.

The star manager will have Michael Cohen and Dana Cohen as co-managers.

The team also employs a four-step analytical and portfolio construction process, headlined by a financial system overlay and the evaluation of key metrics such as credit spreads and credit quality.

The fund does not aim to be consistently market neutral and is expected to be between 65 per cent net long to -20 per cent net short.

It is based on an existing equity long/short strategy managed by Eisman, launched on 1 November 2016.

Since inception to end-December 2018, the strategy delivered a net return of 11.42 per cent, in US dollar terms, against just 1.27 per cent for the HFRX Equity Hedge index.

Eisman said: “We believe it is important to reassess compensation structures, with a focus on long-term return-on-equity over volume. It is also crucial to understand underlying risks.”

Dik van Lomwel, head of EMEA and Latin America at Neuberger Berman, added: “The launch of our UK onshore range, which comes after years of careful consideration, is a significant milestone for our group.”