And finally… how to build a Traitors-style prize pot from £208 per month

Adrian Murphy

With the final today and contestants in the fourth series of The Traitors watching the prize pot dwindle with each challenge that goes by, savers dreaming of a £120,000 bonanza themselves can build up a similar-sized fund from £208 per month according to Murphy Wealth.

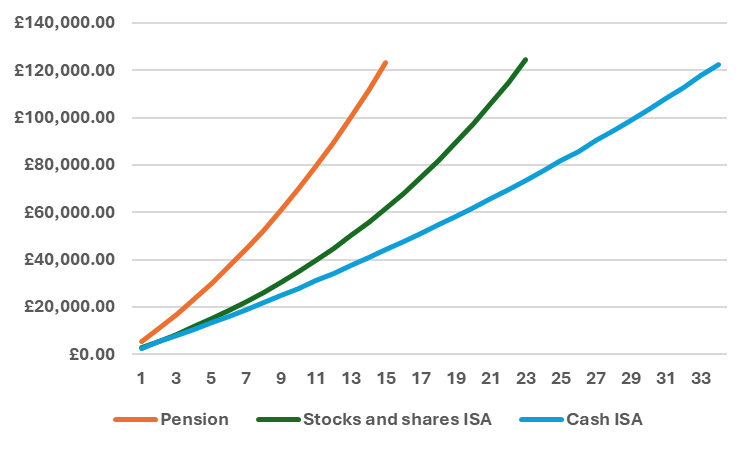

New figures from the wealth manager suggest that saving £208.34 – or £2,500 per annum – from your monthly pay cheque through a pension could boost your savings by more than £123,000 over 15 years.

Murphy Wealth’s calculations assume average annual growth of 6% – well below the 8.7% average of the MSCI World Index for the past two decades – and an employer contribution equivalent to three-eighths of the monthly contribution (or 3% of the 8% minimum overall contribution required through auto-enrolment). They also do not account for costs, which vary by provider.

Contributing £208.34 would result in an employer contribution of £125 – although this may be higher if they will match your personal contribution. The government would then provide another 20% tax relief ‘grossing’ the overall monthly payment to £416.67, building up to £5,000 over the course of a year.

Building a £120,000 prize pot via pension, stocks and shares, and cash

However, it is worth remembering that the winner, or winners, of The Traitors takes the money home tax free. While you can withdraw up to 25% of your pension as a lump sum without paying any tax (up to £268,275), the remainder may be taxable as income depending on your circumstances. You also cannot access a private pension until at least 55 years-old, rising to 57 from April 2028.

For anyone aiming to take the full £120,000 after tax as soon as they have reached that target, they might have to opt to contribute to an ISA. Everyone can contribute up to £20,000 per annum to either stocks and shares or cash ISA accounts – although the rules will change from April 2027, limiting the cash allocation to £12,000.

Contributing the same £208.34 per month would only be equivalent to £2,500 per year, with no employer contribution or upfront tax relief from the government. The same average growth rate of 6% would only be achievable with a stocks and shares ISA – although returns will vary from year to year – and that would mean taking 23 years to reach the same £120,000 target.

For those 100% faithful to cash, the wait could be even longer. Assuming an average annual growth rate of 2% - more than the 1.21% average of the last decade – it would be 34 years contributing the same amount before a cash ISA would reach £120,000.

The Traitors is a BBC reality competition set in a Scottish castle, where contestants work together to build a prize fund while secretly trying to identify the ‘traitors’ among the ‘faithful’. The traitors can steal the prize money by reaching the end undetected, with last year’s celebrity series won by comedian Alan Carr, participating as a traitor.

Adrian Murphy, CEO of Murphy Wealth, said: “These figures underline the power of pensions as a long-term savings vehicle. Employer contributions and the tax relief provided by the government can make a huge difference over time and take years off reaching the same target compared to other forms of saving – at the extreme, potentially more than halving the timescales to reaching £120,000 on the same level of contributions.

“Many people are questioning the effectiveness of pensions now that they are set to become part of people’s estates for inheritance tax purposes and the age of access keeps rising. But they are still the best way to build wealth and fund your retirement, even if they may become the first port of call for income when you stop working rather than one of the last.

“What’s also clear is the difference investing can make to returns compared to cash. While the market can be volatile, stocks and shares have tended to outperform cash over the vast majority of timeframes by a substantial amount. However, the UK is too faithful to cash, which means most people are missing out on better returns – and that needs to change.

“Whatever you are saving for, don’t just go with your gut. Speak to a professional financial adviser about your plans and they can create a portfolio of investments suitable for your goals as well as your appetite for risk, building you a prize pot that can match The Traitors.”