Bamburgh Capital leads £20m+ investment deal for Tekmar Group

Bamburgh Capital, a boutique corporate finance adviser, has facilitated a transaction for its client Tekmar Group, involving an investment of over £20 million from SCF Partners, a US-based private equity firm with its UK base in Aberdeen.

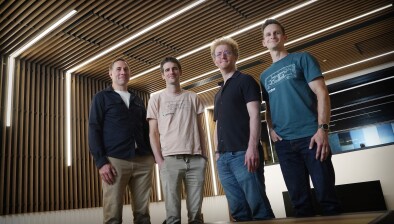

Murdo Montgomery from Bamburgh’s Edinburgh office led the transaction, which saw Tekmar receive a share subscription of £4.275m and an £18m convertible loan note to fund growth, approved by shareholders on April 19, 2023. The company also raised an additional £2.1m from existing shareholders. Tekmar has been supported by Bamburgh since 2021, with Bamburgh advising its board on a strategic review and formal sales process since June 2022.

SCF Partners, headquartered in Houston, Texas, focuses on building energy services, equipment, and technology firms. With a 33-year history, SCF has completed over 370 growth investments into 78 platform companies, helping build 18 public businesses. The partnership with SCF is expected to help Tekmar bolster its position as a supplier of technology and services to the offshore wind market worldwide.

Mr Montgomery, on behalf of Bamburgh, said: “We have been delighted to work with Tekmar on this transformational deal. SCF, which has not previously invested in a UK listed company, is an ideal strategic partner and investor for Tekmar due to its long-term approach and proven track record in the energy industry.

“Through this transaction, Tekmar remains a listed company with a significantly strengthened balance sheet and an ambitious strategy for future growth supporting a very significant opportunity for value creation for the benefit of all investors. In this context, it is notable how this transaction bucks the trend for listed businesses being taken private and leaving the public market.”

Alasdair MacDonald, CEO of Tekmar, added: “Bamburgh demonstrated a valuable combination of skills, approach and expertise in advising the board to navigate a particularly complex process through to its successful conclusion.

“What was particularly apparent is their commitment to achieving the right outcome, both through the sustained effort from a team of experienced professionals and the way they use this experience to provide best-in-class advice and execution and to lead from the front in helping to deliver a successful transaction.”