Brooks Macdonald sees return to positive flows

Caroline Connellan

Edinburgh-based wealth manger Brooks Macdonald has reported an 8 per cent increase in funds under management for the first quarter of the year.

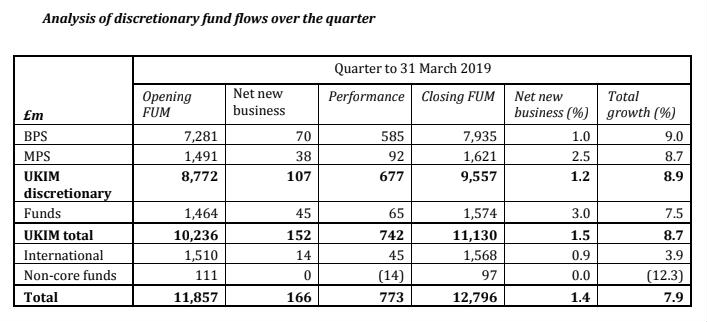

Latest figures show that as at 31 March 2019, the firm’s discretionary manager’s funds now stand at £12.8bn - an increase of 7.9 per cent over the quarter (31 December 2018: £11.9bn). As a comparison, the MSCI WMA Balanced Index increased by 6.9 per cent over the period.

Net inflows of £166m (+1.4 per cent) and a £773m (+6.5 per cent) uplift from investment performance contributed to the rise – with the UK arm of the business accounting for most of those gains (£152m (+1.5%) and £742m (+7.2%) respectively.)

Brooks Macdonald International also reported positive flows, as it was able to recover from a departure of its client-facing team, reported in 2018, which resulted in net outflows.

In the first quarter of 2019, BMI saw £14m (+0.9%) of inflows.

The group also reported it would end its investment management agreement with real estate investment trust the Ground Rents Income fund, which represented £93m of its non-core funds as of 31 March, to “focus on its core offering.”

Brooks Macdonald chief executive Caroline Connellan said: “I am pleased to report we have continued to perform well overall with positive net new business and strong investment performance.

“Although client sentiment remained subdued in the UK against the backdrop of macro-economic and political uncertainty, in that context we maintained decent organic growth, reflecting the strength of our client and adviser relationships.

“The return to positive net flows in International is encouraging, with the changes we announced in March designed to support the future growth of this business.”