RSM UK: Businesses brace for impact but are better prepared

Alex Tait

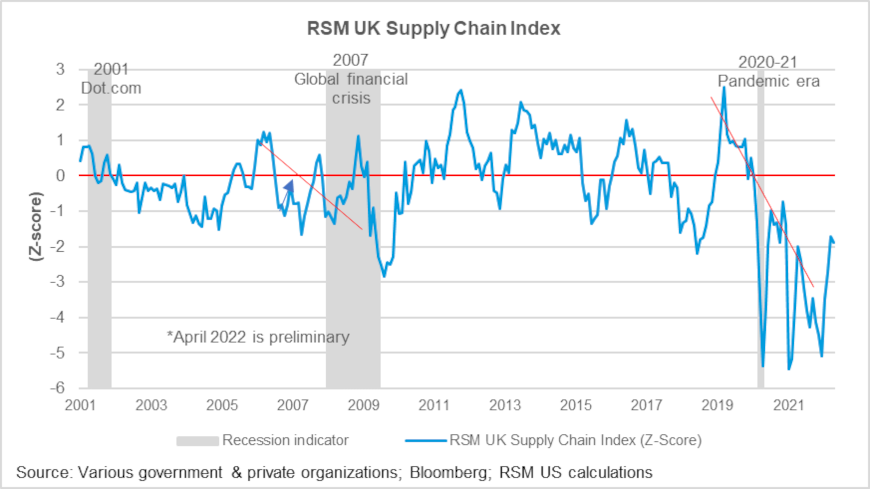

The RSM UK Supply Chain Index (SCI) continued to improve in March, but the firm’s preliminary reading for April showed the first signs of supply chain pressure building again, following a strong rebound in the first quarter (Q1).

Added to the SCI, a recent survey by RSM of middle market businesses in April found that 46% of businesses who had encountered supply chain issues had seen a major increase in the price of goods. It also found that unanticipated supply chain issues had caused 44% of those affected businesses to experience a major hike in operating costs and 42% to see a reduction in profitability.

Alex Tait, regional managing partner for RSM Scotland and Northern Ireland, said: “In the past month our clients in Scotland and Northern Ireland have seen their order books lengthening from their own customers.

“Normally this would be a good sign, but under the current circumstances it puts huge pressure on them. If businesses can’t get supply, they can’t service their order book, which hinders growth and could potentially have more serious consequences for some businesses.”

However, local manufacturers and multinational businesses are better prepared than they were before the pandemic to address such disruptions. RSM’s survey found that, in the last 12 months, 42% of businesses have increased the number of suppliers to become less reliant on one source. A third have nearshored supply chains with another 41% considering this in the next 12 months.

Thomas Pugh, economist at RSM UK, said: “Middle market firms face an increasingly challenging outlook. The Russian invasion of Ukraine has dramatically increased the scarcity and prices of a broad range of commodities, from oil to wheat, and that’s driving up costs.

“Restrictions on exports from Russia and coronavirus-related shutdowns in China risk sparking another supply chain crisis before the economy has recovered from the last one.

“As a result, instead of marking a return to normality after the challenges of the pandemic, 2022 is likely to be another extremely challenging year for the middle market.”

The RSM UK SCI rebounded strongly in Q1, rising another 30%, driven by retailers restocking. However, the index is still 1.8 standard deviations below long-term normal conditions. It’s a sign that, while conditions are improving, supply chains are still under a significant amount of stress.

With the preliminary reading for April suggesting supply chain pressures are starting to build again as the impact of the war in Ukraine and coronavirus-related lockdowns in China start to bite, RSM expects the SCI to fall sharply over the summer.

There is little sign in the official data that either the war in Ukraine or the lockdowns in China are having a major impact yet. The UK imported more from both Russia and China in March than it did in February and the volume of shipping containers travelling from China to Europe and the US rose in March.

March was too soon to see the impact of these major geopolitical events. Shanghai didn’t go into a full lockdown until the start of April. The preliminary RSM SCI reading for April, which relies on more timely survey data, has taken a dip down to two standard deviations below normal indicating that supply chain conditions are worsening. There already anecdotal reports of retailers struggling to acquire stock to sell and manufacturers, such as Mini, unable to get inputs.

It seems likely that supply chains may become significantly more squeezed again over the summer. Congestion at major Chinese ports has more than doubled and anecdotal reports suggests shipments from China to Europe dropped sharply in April. This will feed into higher goods prices, and once shipping resumes from China in earnest in June, shipping costs will probably soar again. Both these factors will push upwards on inflation over the next few months.

This comes at a time when other costs, such as energy and labour bills are rising rapidly and the outlook for demand looks weak.