Chancellor announces raft of measures cutting tax and deregulating fiscal policy

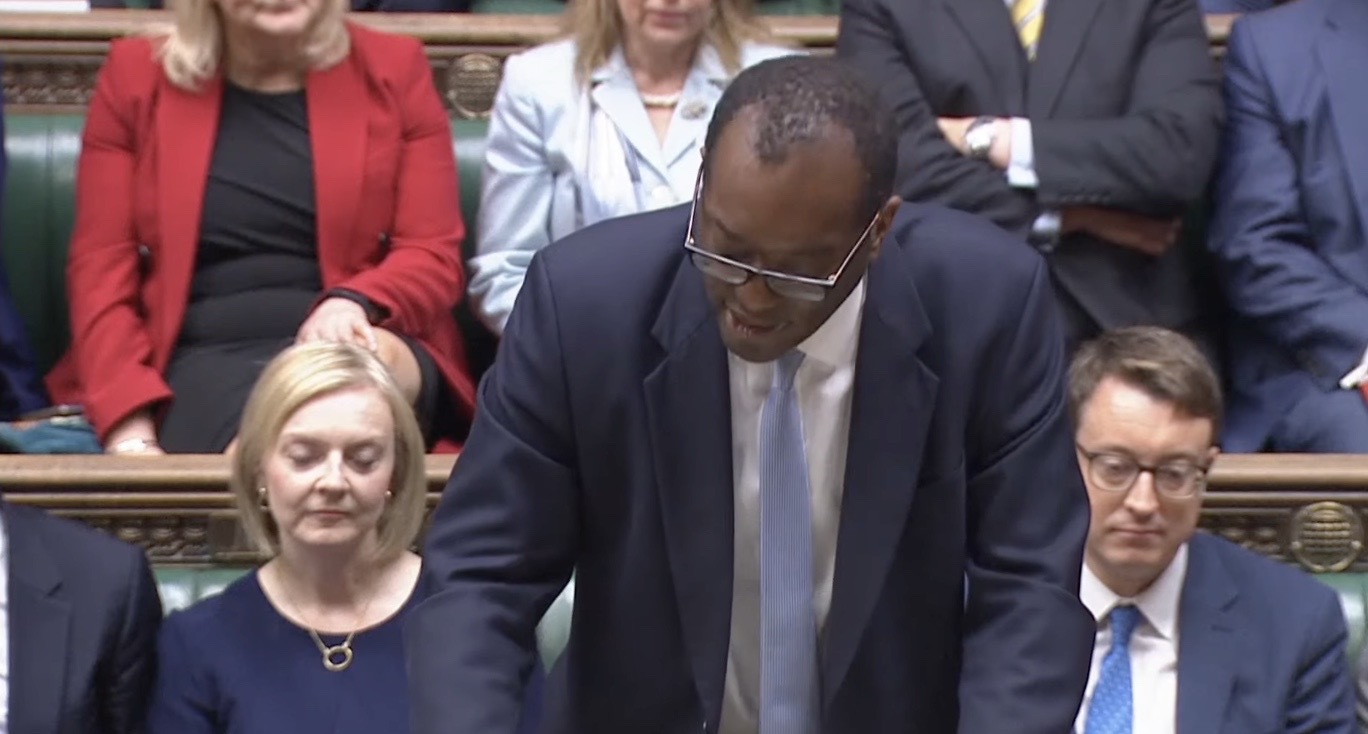

Kwasi Kwarteng delivering his Mini Budget in the House of Commons

Today, Kwasi Kwarteng, the chancellor of the Exchequer revealed his fiscal plans in his emergency ‘Mini Budget’ aimed at boosting the economy to reach his 2.5% growth target.

Mr Kwarteng’s announced tax cuts and reforms, “the biggest package in generations”, were met with mixed reactions.

Chris Sanger, EY’s head of tax policy, comments on the emergency Budget: “Although this was badged as a mini-Budget, the content contrasted well with many Budgets of the past. In making cuts in eight taxes, across 19 measures, reducing the government’s tax take by £146bn.

“The event dwarfed the last budget of the Chancellor’s predecessor, which, whilst it had more than twice as many measures (40), raised £65bn across the six years. In that way, this was no ‘mini’ Budget, but much more of a Rolls Royce.”

Some key points of the ‘Mini Budget’ included:

- Scrapping the 1.25% increase to National Insurance Contributions (NIC) - Effective from November 6th

- Corporation tax rise cancelled, keeping it at 19% - Which was due to increase to 25%

- Basic rate of income tax cut to 19% in April 2023 up to £50,270 - Currently only applies to £12,571 - £14,732 bracket in Scotland

- Stamp Duty Land Tax nil rate band will be doubled from £125,000 to £250,000 - Whether the Scottish Government will adopt this is yet to be seen

- Office of Tax Simplification to be shut down - centralising control

- Lifting cap on bankers’ bonuses

- VAT-free shopping for overseas visitors

- Planned increases in the duties on beer, for cider, for wine, and for spirits cancelled

Commenting on the reversal of the increase to NIC, Alison Hill, tax partner at PwC, said: “The decision to reverse April’s National Insurance increase for individuals and businesses has been long-trailed.

“Changing a tax code midway through the tax year isn’t going to be straightforward but April 2023 is a long way off, and doing nothing was clearly not an option being considered by the new Government given the rising cost of living.

“While this will be expensive, at an estimated annual cost of £13bn, rowing back on the 1.25% increase for employers and employees is a fast and obvious move given the financial challenges faced by so many.

“However despite its apparent simplicity, there are likely to be difficulties implementing it under present government software and challenges for payroll providers, who will have updated only recently updated their systems.”

Many of the announced measures will not automatically apply to Scotland and the Scottish Government is under pressure to follow suit as individuals will be worse off in Scotland than in the rest of the UK.

Daniel Hough, financial planner at Brewin Dolphin, said: “The changes to the tax regime made by the chancellor in today’s budget will likely put further pressure on the Scottish Government to change Scotland’s tax system. No matter what you earn, you are now worse off in Scotland than you would be in other parts of the UK.

“The lowering of the basic income tax rate to 19% now applies from the nil rate of £12,570 up to salaries of £50,270. In Scotland the 19% rate only applies to salaries between £12,571 and £14,732, increasing to 20% for those earning £14,733 to £25,688 and then 21% to £43,662.

“Scrapping the additional rate will also leave those affected paying much more tax in Scotland than they would in other parts of the UK, which could be significant. With the rise of remote working following the Covid-19 pandemic, we could find a situation whereby those in highly remunerated jobs decide to live and pay tax in England but work in Scotland. Ultimately, this would hurt Scottish tax takings if it is not addressed in some way soon.”