Top global bankers support Scottish bond issue

First Minister Humza Yousaf

A panel of experts which includes executives from global finance firms have backed First Minister Humzah Yousaf’s plan to issue Scottish Government bonds.

The panel of experts recommended that a Scottish Bond issue could significantly raise Scotland’s international financial profile, build its credit rating and develop relationships with investors and debt providers. The issue of bonds is part of a wide-ranging package of recommendations from an Investor Panel of senior figures from investment finance, which was tasked with considering how Scotland can attract capital to support a just transition to net zero.

The First Minister announced last week that external due diligence would begin into the proposal – this will involve consultation with banks, credit agencies, financial experts and the Treasury. The Scottish Government will issue bonds when the value for money case supports it from a fiscal and economic perspective.

Executives at Baillie Gifford, such as senior partner Andrew Telfer, Alexandra Basirov, the head of sustainable banking solutions in Europe, Middle East and Africa at Bank of America Bank of America and Judith Cruickshank, the chairwoman of the Scotland board at Royal Bank of Scotland are included on the panel.

Other panellists include Shane Corstorphine, the former finance director at Skyscanner, Baroness Ford, previously the STV chairwoman, and Michael McGhee, the founding partner at Global Infrastructure Partners, The Times reports.

Deputy First Minister Shona Robison said: “Scotland has a wealth of investment opportunities and raising finance to fund infrastructure is key to supporting the Scottish Government’s priorities: delivering high-quality public services, boosting a green and thriving economy and ensuring equality of opportunity for everyone.

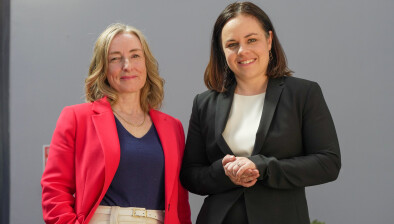

“I welcome the Investor Panel’s recommendation that issuing bonds could help achieve these goals. It is important that we consider all means to attract investment and I have asked for due diligence work to begin with the aim of making the bonds available to the market by the end of the current parliamentary session.”

She added: “While the UK National Loans Fund provides a cost effective source of capital borrowing, the structures available are limited to us. This is why, after added flexibility was secured through the fiscal framework review, it is the right time to re-assess how we use our borrowing powers.

“Scotland is a country that is open to investment, and as part of a full, external due diligence process it is willing to open its public finances to the scrutiny of credit rating agencies. I look forward to setting out further detail alongside the Scottish Budget in December.”