EY: Financial services firms race to hire tech-savvy board members in the face of AI disruption

(Credit: Thapana Studio – adobe.stock.com)

More than half (52%) of board members appointed to UK financial services firms in the past 12 months brought technology expertise to the table – up from 36% the year prior – as AI and emerging technologies rise up the corporate agenda.

The latest EY European Financial Services Boardroom Monitor charts the profile, experience and skillsets of board directors across the MSCI European Financials Index.

The results demonstrate a significantly higher adoption rate of technology expertise to UK financial services boards compared to those across Europe; the 52% of new appointments with technology experience in the UK compares to just 35% in Europe. In addition, 94% of UK boards now include at least two directors with tech expertise, and 50% of boards have at least four, compared to 71% and 35% respectively across Europe.

Breaking down the types of technology expertise UK directors bring to financial services boards, just over a quarter (28%) of appointees in the last year have experience leading a technology-focused team or have held a senior role delivering technology. The same percentage (28%) bring FinTech experience, 8% have IT systems and operations experience, and 4% have previously worked in cybersecurity.

Martina Keane, EY UK & Ireland Financial Services Leader, comments: “Our new findings clearly demonstrate that technology expertise on UK financial institution boards has shifted from ‘nice to have’ to strategically critical.

“In the AI era, data and digital infrastructure will increasingly define both competitive advantage and sustainable growth, making directors with working knowledge and hands-on tech experience more important than ever.

“Innovation brings both opportunity and challenge in financial services, so it is critical that firms implement the right capabilities to support ethical and responsible governance that works now and in the long-term.”

Rising number of women with tech skills appointed to UK financial services boards

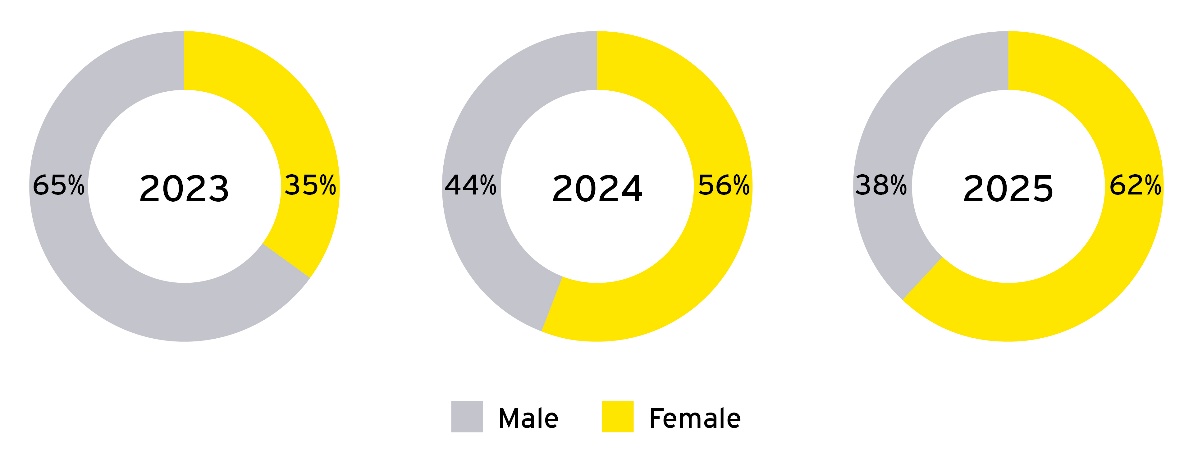

Of the new UK appointees with technology experience over the last year, 62% were women, a considerable uptick from previous years, and 38% men.

The overall gender split of board members with technology experience in UK financial services firms now sits at 45% female and 55% male, compared to 43% female and 57% male a year ago.

Gender balance of new board appointees with technology skills year-on-year

Insurers boost their tech board appointments over the past year

Among specific sectors within UK financial services, insurers in particular have bolstered their boardrooms with technology expertise in the last year, with two-thirds (67%) of new appointees to UK insurance boards bringing this skillset, more than double the prior year of 30%.

In comparison, half (50%) of banking and capital markets appointees bring tech experience – the same as the previous year – and 44% of new board appointees have tech experience in wealth and asset management, up from 29% year on year.

Demand for technology expertise outpaces appetite for corporate finance, sustainability and political expertise

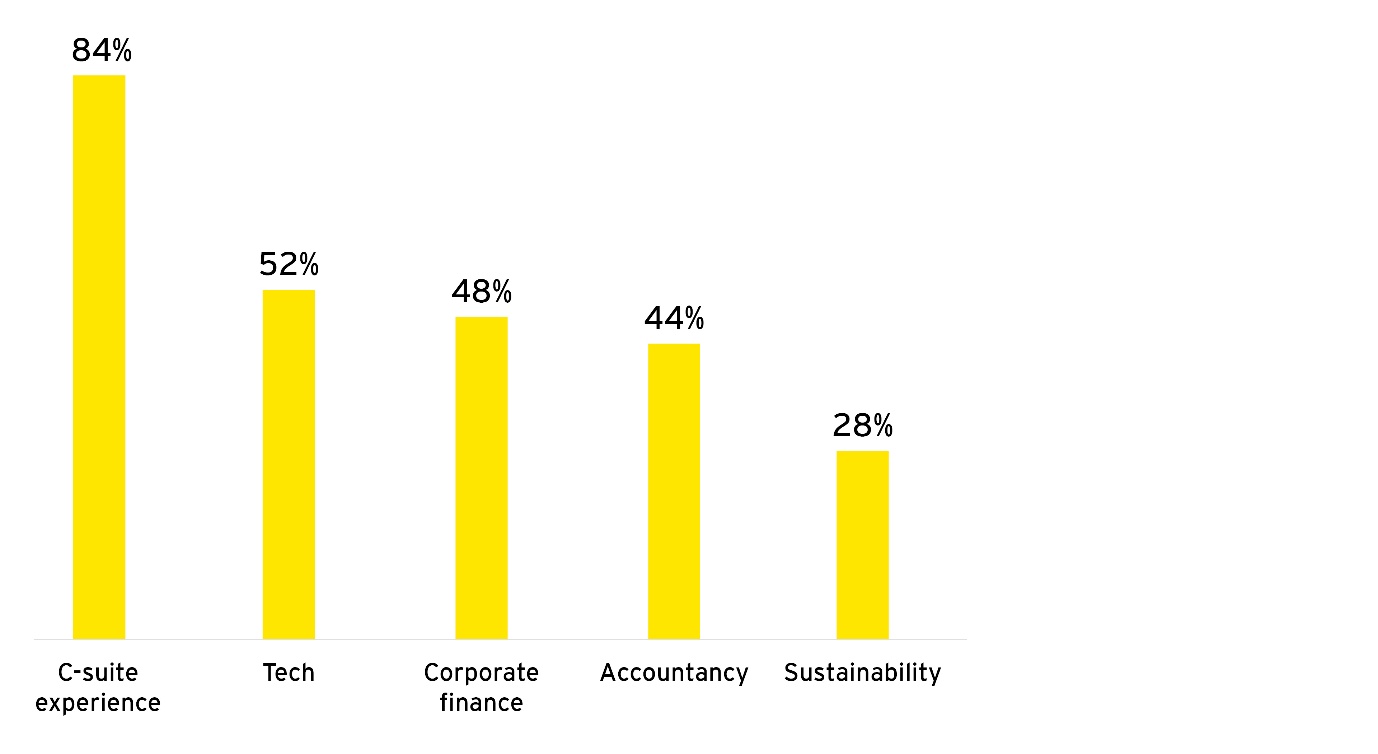

While C-suite experience continues to be the most in-demand attribute for new financial services board directors in the UK – 84% of appointees in the last year brought C-suite experience – technology is now the most in-demand skillset. This is followed by corporate finance expertise (48%), accountancy (44%), and sustainability (28%).

Skillsets and expertise of new UK financial services board appointees

Financial services leaders potentially concerned about ability to mitigate AI risks

In EY’s AI Confidence Pulse Survey, 52% of UK financial services leaders said they felt their organisation’s current approach to technology-related risks is insufficient in addressing new challenges from emerging AI technologies. This represents a marginally higher level of confidence among UK leaders than their European counterparts, with 57% of European financial services leaders claiming that their organisation’s approach was insufficient.

In order to help mitigate these risks, 58% of UK financial services organisations are investing heavily in carrying out risk assessments for new AI models, while 52% are investing heavily in employee training to build skills, best practices and risk awareness around emerging AI technologies.

Preetham Peddanagari, EY UK financial services technology consulting leader, said: “Technology has moved from a back-office enabler to a boardroom capability. With one

“in two new UK directors now bringing tech expertise, it’s clear that governance is evolving as fast as the technology itself. Just as importantly, a growing number of these tech-skilled appointees are women, which strengthens the range of experience around the table and brings broader perspectives that can help financial services firms meet challenges.

“The next phase is execution – model risk oversight, secure data foundations and responsible deployment – so innovation scales safely and delivers value for customers and shareholders.”