Increasing number of Scottish small firms are help back by market uncertainty

In just six months there has been a 13% rise in the number of small businesses in Scotland saying that market uncertainty is holding their business back from growing, according to a new study from Hitachi Capital Business Finance.

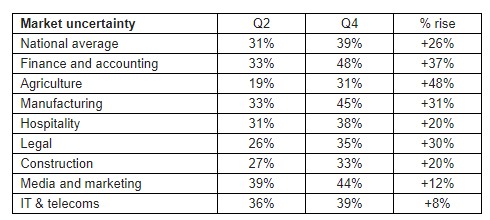

Nationally, small businesses in the accounting (48%) and manufacturing (45%) sectors are most likely to blame market uncertainty as a barrier to growth. In the agricultural sector, this has traditionally been a more moderate issue but this quarter the sector sees the sharpest rise in concerns over market uncertainty – a relative 48% rise in just six months.

At a time when EU leaders have agreed to a further Brexit delay(1), Hitachi Capital’s Business Barometer asked more than 1,200 small business owners which external factors were holding their business back.

It found that 71% of small businesses in Scotland were being held back by factors that were outside of their control, with market uncertainty affecting three in five.

A growing number also cited the falling value of the pound as a big concern in the months ahead, rising from 8% in May to 13% in October.

Although the finance and accounting sector saw the most significant rise in the number of small businesses feeling that growth plans were being held back by market uncertainty(+37%), a growing number of businesses in agriculture and manufacturing admit that market uncertainty is a bigger issue now than six months ago (19% to 31% and 33% to 45% retrospectively).

Other key barriers to growth:

- Uncertainty as to the future of the business (17% in May to 20% in October)

- Volatile cash flow (13% in May to 14% October)

- Unpredictable/bad weather (6% in May to 7% October)

- Old or out-of-date equipment (5% in May to 6% in October)

The research from Hitachi Capital also suggests that the young and most established businesses are most worried about protracted market uncertainty. For enterprises that have been trading for 5 to 10 years, concerns have risen from 29% to 42% - and for those who have been trading for 35 years or more market uncertainty fears have rose from 29% in May to 48% in October.

Gavin Wraith-Carter, managing director at Hitachi Capital Business Finance, said: “With the upcoming General Election, it seems highly unlikely that there will be a clear position on Government policy or Brexit until after the Christmas break. For many small businesses, this will mean planning for a New Year with lots of unknowns as market factors. This could play out with us seeing dip in business confidence at the start of 2020 although, longer-term, when the sector has greater certainty to plan against we envisage small businesses will be the first to see change as an opportunity to grow and diversify.

“One of the remarkable findings from our research over the last year is that, overall, there has been little change in the perceived barriers that small businesses feel they have to overcome to grow their business. Despite a period of unprecedented market volatility and political uncertainty, there has been no significant rise in the proportion of businesses citing red tape, cash flow or access to labour as bigger issues than they were a year ago.”