Knight Frank: £750m invested in Scottish commercial property during H1 2025

Lower Gilmour Place

Scotland’s commercial property market attracted £750 million of investment in the first half of 2025, as investment markets paused for thought amid geopolitical tensions and a changing policy backdrop, according to new analysis from Knight Frank.

The independent commercial property consultancy’s analysis of Real Capital Analytics (RCA) data found the figure was down 20% on the £925m average for the previous five years, broadly in line with the picture across the UK. That, however, includes a particularly strong year in 2022 – if discounted, the average would be £769m.

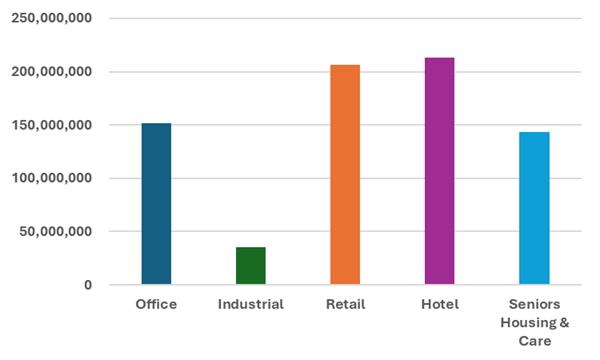

Figure 1: Investment in Scottish commercial property by asset type, H1 2025 (source: Knight Frank, RCA)

For the first time in recent years, hotels were the top-performing asset class, with £213m of investment. That was the second highest figure for the sector during the first six months of the year since 2020, behind only 2024’s £235m. Retail was second with £207m-worth of transactions, followed by offices with £152m.

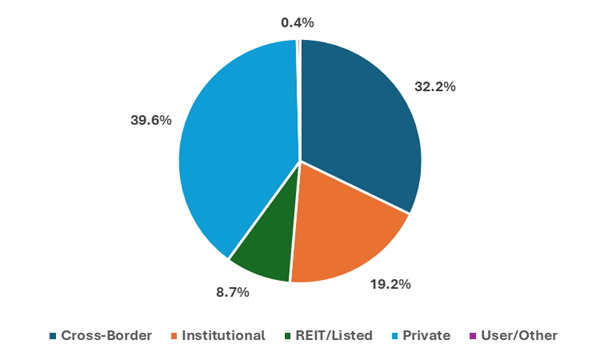

Figure 2: Investment in Scottish commercial property by buyer type, H1 2025 (source: Knight Frank, RCA)

Private investors were the most active buyers accounting for 40% of investment - the highest share for the first half in recent years. International investors were second with 32%; institutions accounted for another 19%; and real estate investment trusts (REITs), listed property companies, and occupiers made up the remaining 9%.

Alasdair Steele, head of Scotland commercial at Knight Frank, said: “A lot has happened in the first six months of the year – both internationally and closer to home.

“The changing geopolitical backdrop has given overseas investors pause for thought, while the Housing (Scotland) Bill’s journey through the Scottish Parliament will be a big influence on appetite for deals in areas like build-to-rent and student accommodation.

“Nonetheless, Scotland has shown an encouraging level of resilience, with investment holding up well despite the level of uncertainty. That is partly a reflection of the deeper buyer pool, with private investors active while other groups have been quieter than usual.”

Alasdair Steele

Mr Steele continued: “At the same time, hotels are emerging as the standout property type, supported by seemingly insatiable appetite for Edinburgh, in particular. With more hotel stock coming online in the city over the next year or so, we could see the strong levels of investment in the sector continue.

“All things being equal, we expect to see a pick up in deal activity during the second half of the year. In a volatile world, commercial property remains an attractive option for investors – and Scotland remains good value within the UK, which itself is widely seen as a safe haven from an international perspective.”