Murphy Wealth: How ISA reforms could make a six-figure difference to your wealth

Adrian Murphy – CEO of Murphy Wealth

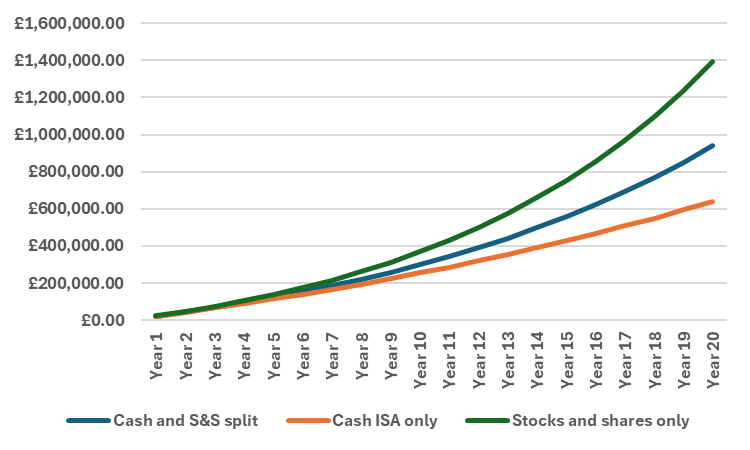

The Chancellor’s decision to limit cash ISA contributions to £12,000 from April 2027 may be unpopular in a nation that prefers the safety of cash, but it could make a six-figure difference to savings over the long term, according to Murphy Wealth.

Analysis from the Glasgow-based firm suggests that anyone fortunate enough to be able to maximise the new annual ISA allowances of £12,000 for cash and £8,000 for stocks and shares could be £300,000 better off than they would have been saving purely in cash.

The MSCI All Country World Index, which comprises a broad basket of shares from across the globe, has delivered an annual average return of 10.82% since 1988 – although, real returns will have been lower, as this does not account for costs.

Meanwhile, the current best interest rate available on a fixed-term cash ISA is 4.3%, according to Money Saving Expert. This could change over time, and often the interest rate offered falls to a much lower level after the fixed term on ISA accounts.

Table 1: ISA pots built up over 20 years with different approaches to saving/investing

| | Pot |

| Cash ISA only | £640,867.20 |

| Cash and S&S split | £942,061.23 |

| Stocks and shares only | £1,393,933.13 |

Nonetheless, using those returns, someone opting to save in a cash ISA could have built up a pot of just over £640,000 over the course of 20 years – assuming they would have been able to use the full allowance. But if they opt to use the £8,000 reserved for stocks and shares, it could boost that figure to slightly more than £942,000.

Choosing to invest the full allowance over the same time frame could be an even more substantial boost, more than doubling the size of the pot to nearly £1.4 million.

ISA pots built up over 20 years with different approaches to saving/investing

The latest data from HMRC shows that in the most recent tax year (2023/24) the number of cash ISAs has risen to 9.94 million – up 2.1 million on the previous 12 months. Meanwhile, the number of stocks and shares accounts only increased by 283,000 to 4.09 million.

Despite stocks and shares now having only a 27% share of all ISAs, they represent 59% of the total market value of accounts, at £511 billion compared to £360 billion for cash. That means the average value of stocks and shares accounts was nearly four times greater than cash ISAs – £124,939 compared to £33,217.

Adrian Murphy, CEO of Murphy Wealth, said: “The UK is a nation of cash savers, so a lot of people will understandably see the £12,000 limit on cash ISA contributions as a negative. But, if they continue to maximise the allowance and use the remaining £8,000 to invest, they could end up a lot better off for it.

“Many people see investing as risky. While stocks and shares can be volatile, and there is no such thing as a guaranteed return, it’s also worth remembering that investing has tended to provide higher returns over the long term.

“ISAs are a case in point. Figures we recently obtained from HMRC showed that 94% of the UK’s ISA millionaires got there through stocks and shares accounts – and none built that level of wealth through cash alone. And despite representing one-quarter of ISA accounts, stocks and shares account for more than half of the total value of ISAs.

“Ultimately, using an ISA to save cash was often a waste of the allowance – ideally more people would be using whatever they can of it each year to shelter investments from tax. If you have any concerns about investing, speak to a professional financial adviser about the best approach for you that aligns with your long-term goals.”