RBS: Scottish private sector outperforms UK average

The Royal Bank of Scotland PMI data for June has revealed a solid and quickening expansion of private sector activity in Scotland, marking a five-month succession of growth.

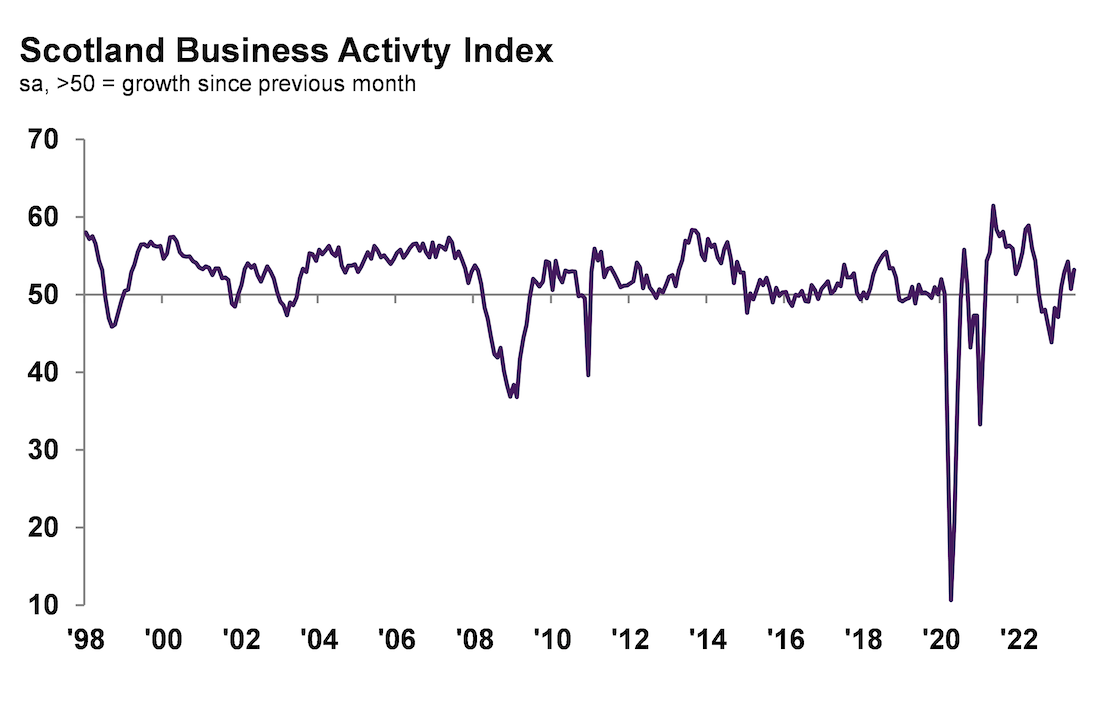

The seasonally adjusted Scotland Composite Output Index rose from 50.7 in May to 53.2, significantly higher than the long-term survey average. Furthermore, Scotland’s growth rate outpaced that of the UK, securing it third place in the regional rankings, only behind London and the South East.

This growth is primarily driven by the services sector, which saw a rapid increase in new business. Meanwhile, manufacturing orders fell, but at a slower rate than before. These trends resulted in Scotland having the second fastest growth in new work among UK regions. However, business confidence did dip to a five-month low, putting Scotland third from bottom in terms of sentiment, outpacing only the North East and Northern Ireland.

Source: Royal Bank of Scotland, S&P Global

June also marked the fifth consecutive month of increased employment in Scotland’s private sector, spurred by new projects and contracts. However, the pace of job creation slackened and fell below the UK average. The services sector saw a rise in outstanding business, while manufacturers reported a sharp drop in backlogs, resulting in an overall decline in Scotland.

The data also noted easing inflationary pressures in Scotland. Input price inflation, although still well above the historical average, continued to cool and hit a 25-month low in June. The slower rise in prices trickled down to the charges for goods and services, which increased at the second-softest rate in over two years.

Judith Cruickshank

Judith Cruickshank, chair, Scotland board, Royal Bank of Scotland, commented: “The Scottish private sector signalled a stronger performance midway through the year. The upturn was largely supported by a quicker expansion across the services sector, while manufacturing continued to exhibit weakness despite registering a slight increase in production

“The diverging trends between the two sectors are a concern as dependence on services grows. This is highlighted by a quicker expansion in new business at services firms, while manufacturers signalled a third monthly contraction in factory orders.

“New orders also give an indication of business activity in the coming months, and the data from June signals growth will remain skewed towards services. Furthermore, outlook expectations across the two sectors also showed more subdued sentiment across manufacturers, while service providers remained upbeat in comparison.

“In terms of prices, inflationary pressures eased in June, with cost burdens rising at the softest rate since May 2021. Panellists largely attributed the upturn in overall cost burdens to increasing labour costs.”

Sebastian Burnside, Royal Bank chief economist, commented: “As we reach the halfway point in the year, it’s an appropriate time to evaluate the trends we’ve seen up to this point and those that are developing as we move into the third quarter.

“Growth so far this year has been led by London, which after a sluggish end to 2022 has recovered strongly and recorded sizeable rises in business activity for the past five months. The capital is beginning to show signs of a loss of momentum, however, which is a pattern we’re also seeing in other areas, most notably in Wales, the North East, East Midlands and South West which have all moved into contraction territory in the past couple of months.

“Only half of the 12 monitored nations and regions saw a rise in new business in June, which, alongside a fall in business confidence in most areas points to a subdued outlook for the near term at least.

“There were some positive takeaways in the latest survey data, including a broad-based easing of price pressures. All areas recorded a slower rise in business costs in June, but in some cases, particularly in London and Scotland, the rates of input price inflation remained historically elevated due in large part to growing wage bills.

“Tight labour market conditions look likely to persist for the time being, with nearly all regions recording an increase in employment in June, which means underlying price pressures could stay higher for longer too.”