Rental stocks fall to all time low as Edinburgh and Glasgow rents reach record high

The high levels of rental activity in Scotland in the previous quarter continued deep into Q4 of 2021 sending stock levels down to record lows and driving some rents to all-time highs, according to a new report.

The latest Quarterly Report from Citylets found that competition for property to rent was frenzied in many locations sending rents significantly higher and Time to Lets (TTLs) materially lower.

Whilst stocks began to recover towards the end of the quarter, the average advertised stock levels over Q4 2021 were just 32% compared to the same quarter in 2018 and at a time when a far reaching consultation was launched into the future of the private rented sector in Scotland.

Citylets said anecdotal evidence from letting agents suggests retention of the existing size of the Private Rented Sector (PRS) is already challenging enough with landlords concerned over key matters of control and increasing tax burden, whilst at the same time conscious of the buoyant sales market and opportunity to take profit.

Demand was further charged by a late student season and concerns to bring forward moves in advance of a worsening Covid situation which, by the same token even pre-Omicron, also likely stymied supply with many tenants staying put in the face of the generalised and increasing anxiety of the time. A pervasive deteriorating picture in the general quality of life emerged in Q4 from the cost of living to even access to basic commodities such as fuel.

Gillian Semmler, communications manager at Citylets, said: “It may have been the festive period during Q4 but it was challenging to find anything to cheer.

“Even pre-Omicron, supply of rental properties was stymied in the face of increased anxiety around the deteriorating quality of life, from worries over inflation to access to basic commodities such as fuel. It wasn’t perhaps the most attractive time to make a house move.”

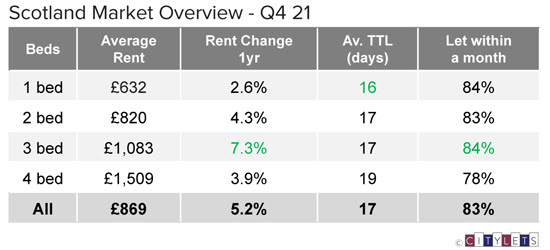

Scotland overall saw positive annual growth for all property types, one to four beds, with the national average rising to £869 per month, up a relatively modest 5.2% year on year (YOY) compared to some major cities, and a steep decline in TTL to just 17 days.

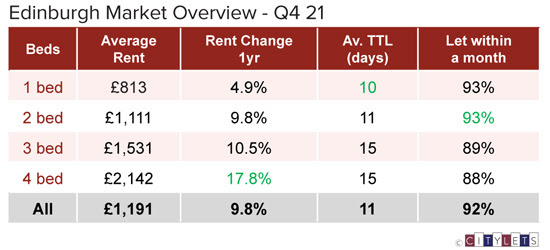

Edinburgh, having returned to positive annual growth last quarter, seemed impatient to erase the recent past posting a significant 9.8% YOY growth pushing the average property to rent in Edinburgh to a new all time high (ATH) of £1191. Once again and consistent with other major conurbations, larger properties posted the largest growth and overall the city average TTL reduced profoundly by 22 days to average just 11 days.

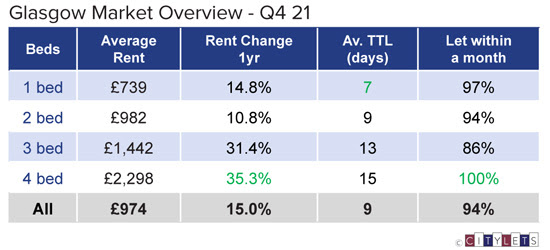

Glasgow however went further with rents increasing no less than 15% to average £974 per month. TTL reduced by 11 days to average just 9 days. Annual growth of over 30% was recorded for 3 and 4-bed properties against a backdrop of severe acute supply shortage which may be short lived.

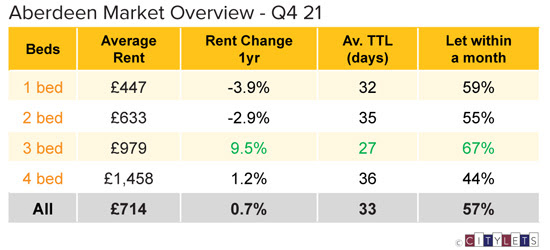

Continued reductions in average TTLs in Aberdeen have now filtered through to rents in the city, now posting positive annual growth of 0.7% to average up to £714 per month. The steepest drops in TTL were once again for the larger 3 and 4-bed properties in high demand accompanied by growth of 9.5% and 1.2% respectively.

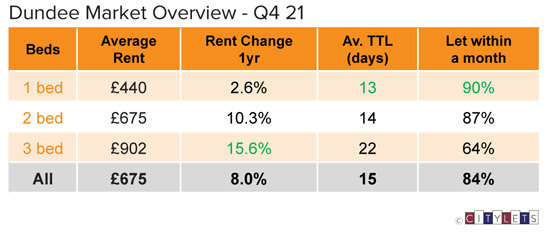

Property to rent in Dundee witnessed strong growth for larger properties raising the city average up to £675 per month with TTLs continuing to fall, now at historic lows of just 15 days.

Commenting on the Scottish market, Karen Turner of Rettie & Co., said: “We have seen the main cities continue to outperform, with Glasgow and Edinburgh racing ahead. Tenant demand is still strong and hasn’t stalled since summer. Properties out with the traditional city boundaries are in high demand as they tend to have gardens and extra space for working from home and offer more space for the monthly rental. Family homes with 4 beds are in short supply. Tenants are more flexible on where they live which has been good for the rural market, pushing rents upwards.”