RICS: House prices in Scotland rise at the slowest rate in over a year

House prices in Scotland rose over the past three months at the slowest rate seen since the beginning of 2024, according to the latest Royal Institution of Chartered Surveyors (RICS) Residential Market Survey.

However, with new buyer activity rising, surveyors expect price growth to pick up over the next few months.

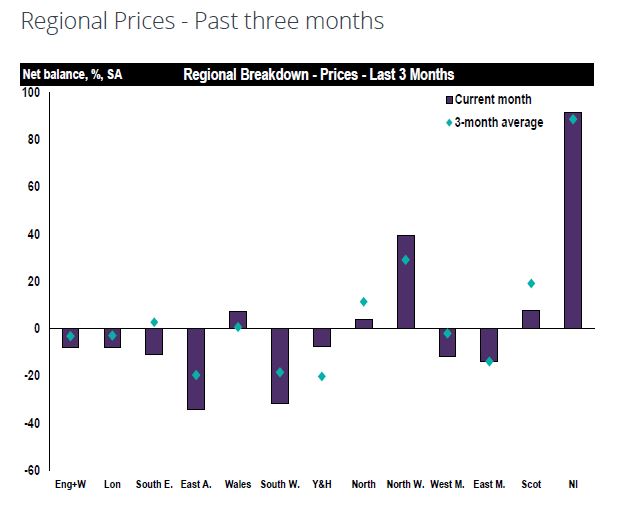

According to the latest survey results, a net balance of 8% of respondents in Scotland reported that house prices increased over the past three months, down from 18% seen in April.

When it comes to price expectations, surveyors appear more positive than seen previously. A net balance of 25% of Scottish surveyors are anticipating that prices will rise over the next three months, compared to the net balance of 8% that was seen in both April and March.

Looking at supply, a net balance of 20% of respondents in Scotland reported a rise in new instructions to sell, indicating a rising number of homes coming to the market for the fourth consecutive month.

On the demand front, a net balance of 23% of surveyors in Scotland noted a rise in new buyer enquiries through May, which is the highest this balance has been in 2025 to date.

When it comes to sales, a net balance of 20% of respondents reported that sales rose through May. And surveyors expect this trend to continue with a net balance of 32% of Scottish respondents anticipating house sales to rise over the next three months.

In the rental market, a net balance of 20% of respondents noted a rise in tenant demand in Scotland, whilst landlord instructions were reported to have fallen flat. Consequentially, surveyors in Scotland anticipate that rents will rise over the next three months (a net balance of 60%).

Commenting on the sales market, Marion Currie, AssocRICS, RICS Registered Valuer of Galbraith in Dumfries & Galloway, said: “New instructions abound, boosting stock and widening the choice for buyers. The summer should see that stock sell where pricing is sensible and / or in popular areas.”

Thomas Baird, MRICS of Select Surveyors Ltd in Glasgow, added: “Uptake in home report instruction is promising for this time of year compared to same time last year. Lower interest rates are helping.”

Discussing the rental market, Carolyn Davies, MRICS of Savills in Dumfries, noted: “We are beginning to see a reduction in the size of rent increases between tenancies, but nonetheless there is continued growth at the moment.”

Commenting on the UK picture, RICS senior economist, Tarrant Parsons, said: “Sentiment across the UK residential property market remains somewhat subdued, with ongoing uncertainty around global trade policies and the dampening effect of transactions being brought forward ahead of the Stamp Duty changes at the end of March continuing to weigh on buyer activity.

“However, near-term sales expectations are showing signs of stabilisation, suggesting that while muted conditions may persist in the short term, a further deterioration appears unlikely. Looking ahead, the outlook is more optimistic, with respondents anticipating a gradual recovery in sales activity over the next twelve months.

“That said, the pace and extent of any improvement will partly depend on the Bank of England’s ability to continue cutting interest rates.”