RSM’s Brexit Stress Index climbs 30 per cent amid political turmoil

After a tumultuous week in politics, a new weekly index run by accountancy firm RSM tracking the impact of Brexit has revealed an almost 30 per cent rise in overall stress levels in the UK economy over just one week.

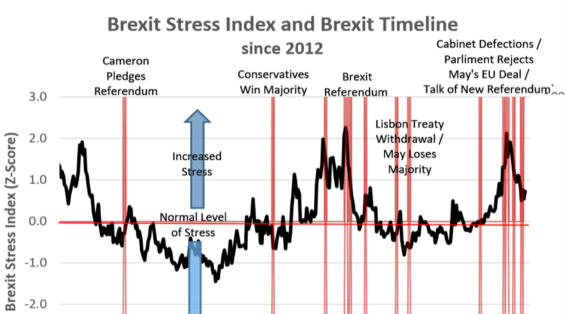

The RSM Brexit Stress Index – which tracks the impact of Brexit on trade, wealth, the business cycle and corporate profits – increased to 0.71 points above neutral in the week ending 22 March, up from 0.55 in the previous week.

To put this into context, it is important to note that the index has declined from over 2 points above neutral in December 2018, mostly due to financial markets pricing in a reduced probably of a hard exit from the EU. However, the events of the last week could mark the start of a reversal of this trend.

Over the last week, the factors pushing the index higher were primarily volatility across the foreign exchange markets linked to declines in the value of the pound.

The FTSE 100 also fell on the week amid the political fallout from the European Council summit.

The RSM Brexit Stress Index tracks the weekly performance of six variables – the pound/euro exchange rate, the volatility of the pound/euro exchange rate, the performance of the equity market, the volatility of the equity market, the yield curve spread and the corporate yield spread.

These variables are combined into a single measure and assessed against a baseline ‘normal’ level of stress in the economy. The baseline zero score indicates neither an increase or decrease of stress in the system. The index is designed to give forward-looking investors, business executives and policymakers an instant snapshot of the economic impacts of Brexit.

Simon Hart, RSM’s Brexit lead partner, said: “The political events of the last week have understandably put greater pressures on the UK economy. The factors driving the index into higher stress levels were primarily the volatility across the foreign exchange markets linked to declines in the value of sterling and the FTSE 100 decline on the week amid increased volatility over the past few days.

“Should the coming days produce similar political turmoil as last week, policymakers, middle-market business leaders and investors can expect stress in the financial markets to increase sharply, creating risks of a spillover into the real economy that would further depress productivity-enhancing investment in the UK. In those circumstances, the RSM Brexit Stress Index would increase in the week ahead.

“In addition, over recent weeks, we have seen more evidence of a slowdown in economic activity in both the US and Germany which has raised the risks of global recession over the next 12 months.

“This combination of stress related to the path of policy on Brexit and the increasing global headwinds faced by the British economy point towards more difficult challenges ahead for UK economic policymakers. Whatever the outcome of the next few weeks of negotiations, the government will need to find ways of stimulating the domestic economy, driving up private fixed business investment and reducing business uncertainty.”