Scottish commercial property poised to rebound following 2023 investment dip

7 Castle Street, Edinburgh

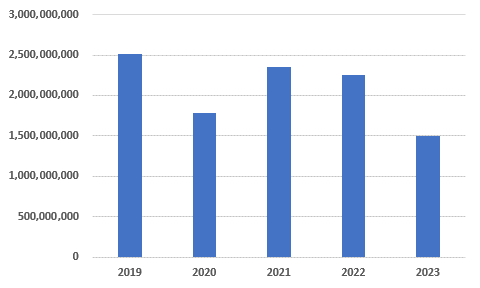

Scotland’s commercial property market witnessed £1.5 billion worth of assets changing hands during 2023, as the market adjusted to the sharp rise in interest rates seen since December 2021, according to research from Knight Frank.

The independent commercial property consultancy’s analysis of Real Capital Analytics (RCA) figures found that total investment volumes dropped by around 33%, broadly in line with the rest of the UK.

Edinburgh continued to prove its attractiveness to investors by bucking the trend with a 23% rise in investment between 2022 and 2023, from £558 million to £686m. Glasgow and Aberdeen saw drops of 72% (£1.2bn to £330m) and 63% (£229m to £84m), respectively – however, they both had a strong year in 2022 to compare with.

Figure 1: Total annual investment in Scottish commercial property 2019-2023 (source: RCA)

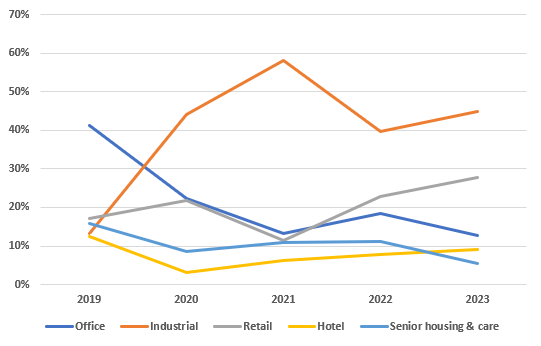

Industrial’s share of investment volumes remained strong at 45% of 2023’s total, slightly above the five-year average of 40%. Activity in the office market reached its joint lowest point in the past five years, representing just 13% of investment; but retail’s share has increased from a low of 11% in 2021 to 28% during 2023.

Figure 2: Share of investment in Scottish commercial property by property type, 2019-2023 (source: RCA)

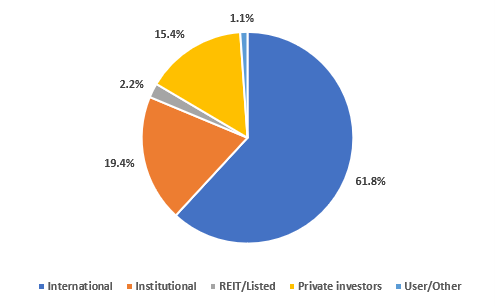

International investors remained the most active buyers of Scottish commercial property, accounting for 62% of investment volumes last year. Private investors represented 15%, as more opportunities opened up for cash-rich high and ultra-high-net-worth individuals against an expensive lending backdrop, while real estate investment trusts (REITs) and listed property companies accounted for just 2% of activity.

Figure 3: Share of 2023 investment in Scottish commercial property by buyer type (source: RCA)

Alasdair Steele, head of Scotland commercial at Knight Frank, said: “The last 12 months have seen a huge change in the investment landscape, with interest rates rising 14 times in a row between late 2021 and August 2023.

“That has inevitably had a big impact on the market and many property owners have decided to hold onto their assets – where they can – until there is a greater degree of certainty, while many buyers also paused until borrowing conditions improve.

“With signs that interest rates may have peaked and the economy is beginning to pick up, there are reasons for cautious optimism about 2024. There are a good number of assets currently on the market which should transact in the first half of the year and there are potential buyers showing more interest.”

Mr Steele continued: “All things being equal, we could see a rebound from the investment volumes of last year.

“As the cost of borrowing and interest rates on bank deposits both reduce, commercial property should start to become more attractive.

“It is likely to be a gradual improvement rather than a sudden opening of the floodgates, and we would expect the primary focus to be on good quality, fit-for-purpose assets across various sectors of the market.”