Scottish Government confirms discussions on windfall tax

The Scottish Government has confirmed it has entered discussions with the UK Government over Scottish Green proposals for a windfall tax on companies that have greatly increased profits during the coronavirus pandemic.

The profits of supermarkets was raised by Scottish Greens MSP Mark Ruskell in April, predicting that Tesco, Sainsbury’s, and others would post record profits during lockdown.

Mr Ruskell raised a windfall tax at COVID committee last month after it emerged that prediction had come to pass, including for online retailers like Amazon.

Some of these businesses have benefited from emergency stimulus funding, and yesterday announcement from Tesco that it will voluntarily repay £585m of rates relief.

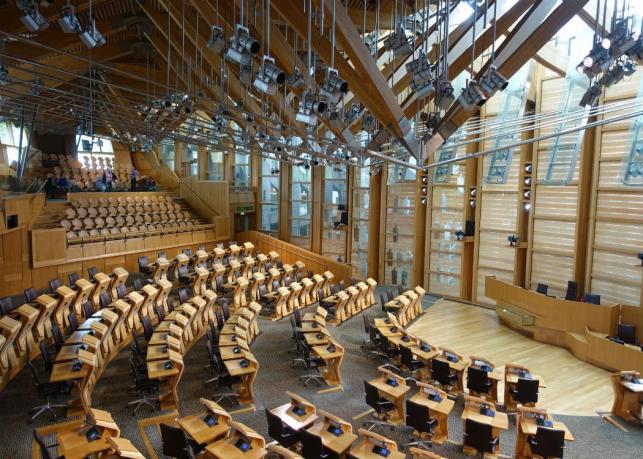

This was raised by Mark Ruskell in the Scottish Parliament yesterday, and in response Ben MacPherson, minister for public finance, said: “The Scottish Government is engaged, as you might expect, with the UK Government on a windfall tax.”

Responding, Mark Ruskell said: “It’s clear that the gap between small retail businesses and giant corporations is widening because of this pandemic, which will have a devastating impact on our already struggling high streets.

“Tesco has shown that companies who have made astronomical profits from COVID have a duty to pay back support funding, but a voluntary approach alone won’t save our smaller businesses.

“I’m very pleased that the Scottish Government has decided to take the idea of a windfall tax forward in discussions with the UK Government. This tax could be a useful tool to ensure that there is more support for the businesses that are being crippled by this pandemic.”

Yesterday, Tesco announced that it will repay the £585 million of business rates relief received in respect of the COVID-19 pandemic.

Tesco’s latest estimate at its Interim Results in October was that COVID would cost Tesco c.£725m this year. However, the retailer said that as the business had proven itself resilient ‘in the most challenging of circumstances’ it would return the business rates relief received in full.