UK fraud losses exceed £629m in first half of 2025

Criminals stole £629.3 million through payment fraud in the first six months of 2025, a 3% increase compared to the same period last year, according to a new report from UK Finance.

The data revealed a 17% rise in the number of confirmed cases, totalling over 2.09 million incidents.

Despite the rise in successful fraud, the banking sector significantly increased its prevention efforts. Advanced security systems stopped an additional £870m of unauthorised fraud from being stolen, a 20% improvement on last year. This is equivalent to stopping 70p in every £1 attempted by criminals.

The report distinguishes between two main types of fraud. Losses from unauthorised fraud, where money is taken without the customer’s knowledge, fell by 3% to £372m. In these cases, customers are legally protected and over 98% are fully reimbursed.

However, losses from Authorised Push Payment (APP) fraud, where victims are tricked into sending money to a fraudster, rose by 12% to £257.5m. The primary driver for this increase was a 55% surge in losses to investment scams, which totalled £97.7m. Purchase scams remained the most common type of APP fraud by volume, accounting for 72% of all cases.

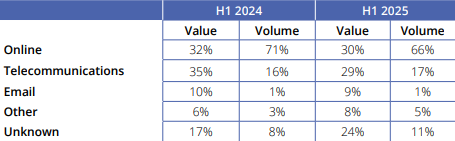

UK Finance highlighted that the majority of APP scams do not start within the banking system. An estimated 66% of cases originated on online platforms, including social media and auction sites, with a further 17% beginning through telecommunications networks.

Ben Donaldson, managing director of economic crime at UK Finance, stressed that fraud is a major threat to the UK economy. He said: “Despite the ongoing investment and prevention measure by the industry, the majority of fraud originates outside the banking system, online and over the phone, where manipulation begins long before any payment is made.

“The scale of the threat is not commensurate with the current level of government investment in countering it or the insufficient action by other sectors. The government must prioritise prevention and hold the social media and telecommunications industries to account in its new Fraud Strategy.”

In light of these findings, UK Finance is calling on the UK government to use its upcoming Fraud Strategy to make prevention a central pillar. The organisation is urging that technology and telecommunications sectors be held accountable and be required to contribute to reimbursement for fraud that originates on their platforms.

Jonathan Frost, global advisory director at BioCatch, said: “Whilst UK banks prevented £870m worth of unauthorised fraud in the first half of 2025, equivalent to 70p out of every pound, fraudsters continue to prove among the world’s greatest innovators, making away with more than £600m from UK consumers in just six months.

“The continued growth of authorised push payment (APP) fraud remains a major concern. Stopping APP fraud will require more than just technology.

“It necessitates both better and cross-industry collaboration. The UK market is primed for real-time intelligence-sharing and should embrace it to continue leading the global fight against fraud.”