Virgin Money adds Accelerated Payments to its fintech partnerships

Clydesdale Bank owner Virgin Money has strengthened its technology expertise, partnering with global invoice financing firm Accelerated Payments to support the development of its business banking proposition and bring additional services to customers.

The fintech, which has offices in London, Dublin and Toronto, offers flexible and efficient working capital solutions to help businesses manage their immediate cash flow. This is achieved by paying the individual invoices of companies up front and providing bad debt protection against their debtors, thereby freeing up capital that is tied up in paperwork.

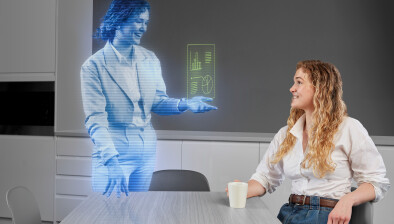

The service offered by Accelerated Payments is easy to use - companies simply access a client portal that allows them to upload and select invoices for funding. Once approved, payment is advanced within 24 hours.

The Accelerated Payments partnership forms part of Virgin Money’s working capital health proposition, which will transform its existing business current account offering, through market-leading digital money management products and services.

Last week, the bank launched its new M Account for Business, which has no monthly fee and free digital transactions, and has been designed for entrepreneurs, start-ups and small businesses with an annual turnover of under £1m and who prefer to do their banking digitally.

Graeme Sands, interim head of business banking, at Virgin Money, said: “We have been working to deliver a suite of services that supports an enriched digital customer experience. As well as the provision of new capabilities, we are also developing a range of tools to help customers manage and improve their financial health.

“We understand the power of fintech and the expertise it offers as we shape our new digital offering. Accelerated Payments’ invoice finance solutions will offer our customers help in addressing cash flow concerns that are a regular occurrence for many businesses. Having this kind of innovation will be a powerful tool for customers.”

Colm Devine, head of business development and co-founder, added: “Virgin Money is one of the most successful and well-established banks in the UK, and its decision to engage with Accelerated Payments is a testimony to our world-class reputation in the fintech sector. By working closely with Virgin Money, we gain a bigger platform to educate more SMEs about the availability of invoice financing and to help more companies scale up and go global.

“We are excited about this strategic partnership and look forward to leveraging Virgin Money’s network and continuing our good work in offering a lifeline to those that are struggling with business cash-flow challenges during this critical time.”