Virgin Money invests £130m in AI to strengthen defences against growing cyber risks

Clydesdale Bank-owner Virgin Money, headquartered in Glasgow, has revealed a strategic investment of £130 million in artificial intelligence (AI) and new technologies aimed at bolstering its defences against cybercrime and securing the future of the business.

This investment, which is part of a three-year plan, includes a £40m budget for the fiscal year 2023-24, is a response to the growing sophistication and risks associated with AI-driven fraud attacks.

The banking group, transitioning from its traditional Clydesdale Bank and Yorkshire Bank brands, has acknowledged that this initiative will affect its financial performance, necessitating an annual cost reduction target of £200m. This is an increase from the previous £175m target and will be achieved through further downsizing of real estate, outsourcing, and simplification of systems. The cost-cutting measures are expected to continue, following a trend that has already seen branch closures and a reduction in office space due to the shift to online banking services.

Clifford Abrahams, the chief financial officer, conveyed that the digital transformation would inevitably lead to the loss of certain roles, especially those related to the bank’s property consolidation. However, Virgin Money is set to introduce new positions in areas such as fraud and financial crime to mitigate the threats posed by technological advancements.

The bank had previously disclosed plans to close 39 branches, which represented nearly one-third of its UK network, threatening 255 jobs. This came alongside a report of a significant drop in full-year statutory pre-tax profits, which fell by 42% to £345m, coupled with a considerable increase in provisions for bad loans.

CEO David Duffy said: “We made good progress executing our strategy in 2023, growing both our relationship customer base and target lending segments. With the momentum we carry into 2024, we are confident in the outlook for our business and we expect to deliver around £800m in distributions to our investors by the end of the three-year period ending in 2024.

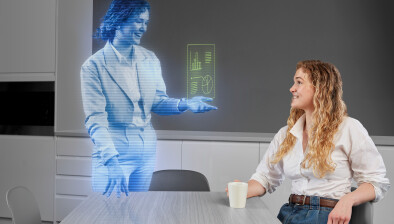

“Under the Virgin brand, our ambition is to create the UK’s best digital bank. To help achieve this goal, we are stepping up investment in our technological capability to future proof our business and protect our customers from the growing risk of fraud strategies driven by advances in AI.”

The bank has also announced a larger-than-expected £150m share buyback program, above prior guidance, taking FY23 buybacks to £200m.