Clydesdale Bank owner Virgin Money profits down 25% amid higher bad loan provisions

Virgin Money’s pretax profit for the six months to 31 March 2023 dropped 25% to £236 million, exceeding analysts’ estimates of £226m.

The fall is attributed to a larger than expected increase in provisions for potential bad loans, which jumped to £144m from £21m in the same period last year, surpassing expectations of £129m. This comes despite a 10% increase in revenues to £933m, bolstered by rising interest rates.

Expenses rose 5% to £477m, reflecting investments in service and mortgage digitisation. The bank’s net interest margin expanded to 1.91%, contributing to a 9% increase in interest income. Total deposits grew by 2.6% to £67 billion, with 72% insured.

The FTSE 250 lender increased its interim dividend to 3.3p per share and plans a 30% full-year dividend payout ratio. Further share buybacks are anticipated, subject to the Bank of England’s stress tests. Shares in Virgin Money have declined 16% this year, impacted by concerns of wider contagion in the banking sector.

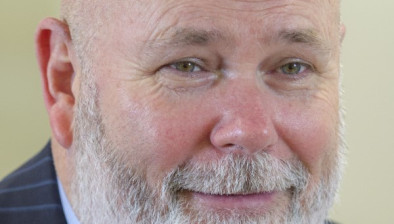

CEO David Duffy said: “More people are choosing to bank with Virgin Money. While the past six months have seen turbulence in the economy and in the financial system, we have continued to focus on our target areas, growing customer numbers and deposits thanks to our new and existing digital products. Further customer-centric product launches are coming in the second half of the year.”

“We have a strong capital position and we’ve significantly grown pre-provision profit, while continuing our prudent approach. As the UK economy stabilises in the months ahead, we have a high degree of confidence in our long-term plans.”