Virgin Money to close six Scottish branches amid digital banking shift

Virgin Money has revealed it will shut six Scottish branches as part of its broader strategy to respond to changes in consumer banking behaviour.

The move reflects a consistent reduction in in-branch transactions with the targeted outlets witnessing a 43% decrease since March 2020. It was found that 96% of customers at these branches transacted less than once per month on average.

The banking firm asserted that these decisions have been made after analysis of several parameters, including footfall, transaction volumes, the prevalence of potentially vulnerable customers, and the accessibility of alternative services such as free-to-use ATMs and Post Offices. The bank has assured that each closing branch is situated less than half a mile from the nearest Post Office, thereby providing customers with an accessible alternative for routine transactions.

The Scottish branches set for closure are Irvine, Newton Stewart, Ellon, Fort William, Lochgilphead and Turriff.

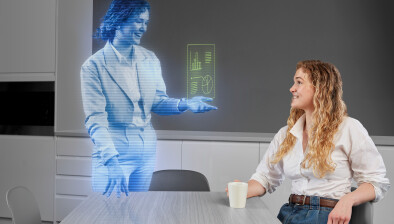

Sarah Wilkinson, chief operating officer at Virgin Money, said: “The decision to close a store is never taken lightly. But as our customers continue to change the way they want to bank with us, by conducting fewer transactions in-store and adopting the convenience of digital banking, we must respond to that evolving demand.

“Our focus is on supporting our customers and colleagues. We have considered the number of vulnerable customers using each store very carefully throughout the review process as a key factor in our decision making, and will proactively provide enhanced, bespoke care to ensure any vulnerable customers affected are supported through the changes.

“For our colleagues, we will pursue all options to retain as many as possible within alternative roles, and have had great success previously with store colleagues moving to other customer operations roles, as their skills are highly transferable.”

In addition to the Scottish closures, 32 more Virgin Money branches across the UK will be shut down. Customers will be given a written notice at least 12 weeks prior to the closure of each affected branch, detailing alternate banking methods.

Despite these closures, Virgin Money maintains that physical stores are still integral to its operations. The bank has invested around £5 million this year in refurbishing stores and equipping colleagues with necessary tools to serve customers. After these planned closures, which are set to be executed later this year, Virgin Money will operate a total of 91 stores across the UK.