KPMG: Zombie firms dragging down Scottish economy

Blair Nimmo

The rising prominence of so-called ‘zombie firms’ – companies under sustained financial strain – is threatening to cause a significant drag-effect on the UK economy, new analysis from KPMG has found.

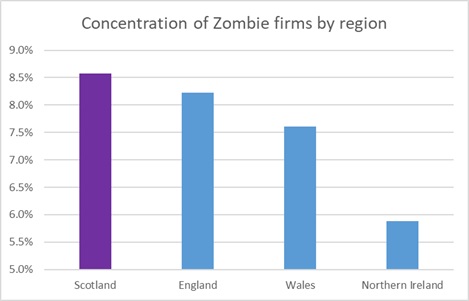

A look at the last three annual accounts of listed UK companies (FTSE and AIM) reveals Scotland has a higher prevalence of zombie companies than any other home nation.

Analysis shows that of the 1,084 Scottish companies analysed, 9 per cent display zombie-like symptoms which include; static or falling turnover, low profitability, squeezed margins, low cash and working capital reserves, high leverage levels and limited ability to invest in new equipment, products or processes. This compares to national level of 8 per cent.

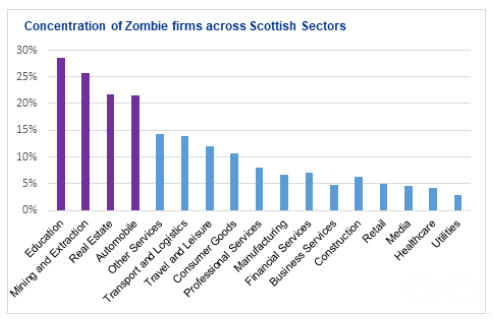

KPMG’s analysis also focused on the prevalence of zombie firms by sector, highlighting the high risk of contagion for lenders exposed to the worst-affected industries. Through a detailed look into publicly traded accounts in Scotland, it found the highest concentration of zombie firms is in the education (29 per cent), mining and extraction (26 per cent), real estate (22 per cent) and automotive (21 per cent) sectors.

In education, ongoing pressures to balance books amidst falling international student numbers in the face of Brexit, coupled with other financial challenges, has resulted in a high concentration of zombie firms in the sector. Despite a marked improvement in oil prices following the slump, the Scottish oil and gas sector has struggled with low levels of capital expenditure projects in the North Sea. Alongside significant cost and pricing pressures this has made it difficult for the supply chain to mount a sustained recovery – as reflected by the high number of mining and extraction zombie firms.

In real estate, reduced occupancy levels, declining rents and falling v

alues in the retail sector is having a significant impact on concentrations. The automotive sector also raised cause for concern, with numbers of zombie firms being driven by car dealerships facing pressures from ongoing consumer uncertainty over Brexit, coupled with a move away from diesel, and restricted availability of new vehicles as a result of new WTLP emissions standards.

Blair Nimmo, head of restructuring at KPMG in the UK, said: “For the past decade, zombies have been allowed to sleep walk largely undisturbed, thanks to an extraordinary monetary and political environment, coupled with lenders exhibiting greater creditor forbearance to struggling companies in their portfolios.

“The uncomfortable truth, however, is this environment is unlikely to persist indefinitely. In the event of a liquidity squeeze, many of these underperforming businesses would fail – and if this happens, the potential for contagion is very real, creating broader challenges for an economy already struggling to deal with a plethora of issues.

“The good news is that prognosis doesn’t have to be terminal – but, as with many things in life, acting sooner rather than later provides more options and can improve the chances of recovery. Urgent dialogue is required between regulators, banks and businesses in order to minimise the ongoing drag these companies have on the economy, and to mitigate against potential risks in the event of an economic downturn.”

Across the UK, of the circa 21,000 private companies that KPMG analysed, 60 per cent display one or more of the symptoms associated with zombies, while just 8 per cent display three or more. However, based on the latest data from 2018, and taking account of the recent increase in BoE interest rates, the share of zombie companies spanning the whole of UK plc could actually be as high as 14 per cent.

The worst affected industries are travel and leisure (12 per cent), real estate (11 per cent), financial services (10 per cent) and professional services (10 per cent).

Yael Selfin, chief economist at KPMG in the UK, said: “The threat zombie companies pose to the wider economy is very real, regardless of what the post-Brexit environment looks like. Many unproductive businesses have been able to stumble on in recent times, generating just enough profits to continue trading but without the innovation, dynamism or investment necessary to sustain bottom-line growth. This has, and will continue to, create a drag on UK productivity, which continues to lag our peers in the G7 and much of Europe.

“If interest rates rise further, highly-leveraged businesses may soon find that borrowing will become more difficult to repay, and if the economy continues to stutter, these businesses will be left especially vulnerable to adverse market forces or a tightening of liquidity – as will the lenders they rely on.”