Aberdeen Investments completes two Tokyo property deals

Aberdeen Investments has expanded its residential portfolio with two real estate acquisitions in Tokyo.

This expansion comprises WORVE Yokohama Isezakicho, a newly completed build-to-rent property, alongside a portfolio of 29 residential properties across some of Tokyo’s most sought after districts.

The acquisition of WORVE Isezakicho was completed in February 2025. It is a 15-story building comprising 218 residential units and 4 retail units located in Yokohama’s central business district within Greater Tokyo. It is a residential mix of 184 studio units and 34 family-type units, catering to singles, couples, and families. The property offers excellent connectivity via public transportation and sits in one of the city’s most vibrant commercial and residential areas.

The second acquisition is a portfolio of 29 recently completed build-to-rent properties, featuring 671 residential units and 2 retail units with weighted average age of 4.3 years. The portfolio includes 580 studio units and 91 family-type units, all situated in Tokyo’s most sought-after residential districts across the Tokyo’s 23 Wards, including Centre, South, and West.

These acquisitions follow Aberdeen’s strategic expansion into Japan’s living sector. In October 2024, Aberdeen announced its entry into the market after being awarded a mandate of a Japan residential portfolio. In May 2025, Aberdeen further strengthened its presence with the acquisition of two high-grade residential rental properties.

Jason Baggaley, head of living, value add, and APAC direct real estate at Aberdeen Investments, said: “We have a very strong real estate team based in Tokyo that was able to source and acquire the portfolio off-market and secured both investments at attractive prices.

“We are looking to grow our real estate business in Japan by building on the strong capabilities we already have.“

Outlook of multifamily properties

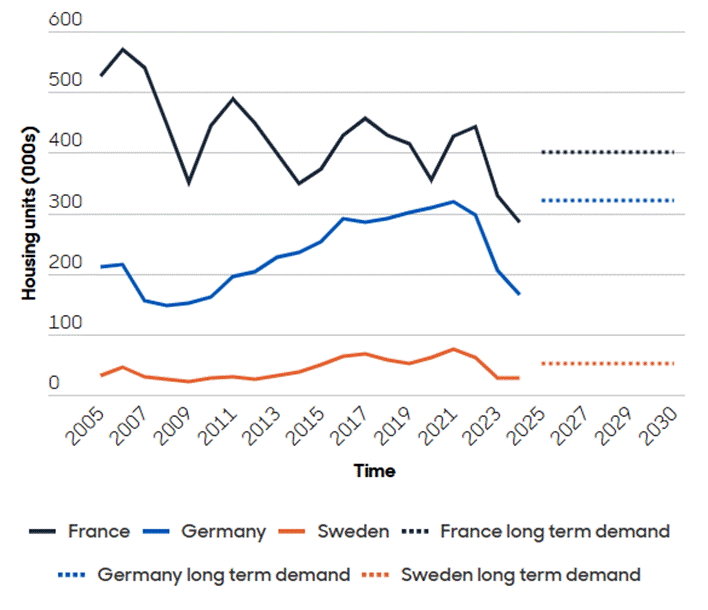

Globally, rented residential has become one of the most transacted sectors in real estate and remains a top investment theme in 2026. Markets such as Germany and France face a chronic housing shortage which has led to strong policy interventions that often increase the barriers to new supply, leading to the predicted ongoing shortfalls (shown in Chart 1). This has created a new opportunity to source investments that can offer consistent, inflation-linked returns that are backed by factors driving long-term demand and supported by financial incentives and deal structures that meet the needs of investors.

Chart 1: Housing completions and estimated long-term demand

(source: Euroconstruct, Eurostat, August 2025. Long-term demand forecast from Euroconstruct.)

In Japan, multifamily properties recorded a 350% year-on-year surge in investment volumes in Q2, supported by post-Covid net migration into major cities, rising wages amid a tight labour market, and the end of decades-long deflation requiring a broader mix of properties to suit different needs. Tokyo’s 23 Wards saw average market rents grow at a CAGR of 3.9% over the past three years, compared to 2.3% annually over the past decade. Greater Tokyo areas such as Yokohama and Kawasaki registered 3.4% CAGR over three years, versus 2.0% over ten years.

Harumi Kadono, head of Japan real estate, Aberdeen Investments, commented: “Structural demand drivers – such as sustained net migration, growth in single-person and DINK (Dual-Income, No Kids) households, and elevated development costs limiting new supply – will keep multifamily vacancy rates tight.

“High condominium prices are also pushing more households to rent. While strong rental growth has been concentrated in Tokyo’s Central 5 Wards, we expect this trend to extend to peripheral wards and Greater Tokyo areas like Yokohama and Kawasaki as households seek more affordable options.”

As an active participant in the global real estate market for many years, Aberdeen has extensive experience in managing direct and indirect real estate investments, real estate multimanager services, listed real estate, and real estate debt solutions. As of 30 September 2025, Aberdeen managed £36 billion in real estate assets.