ACCA abandons remote exams as AI cheating outpaces safeguards

ACCA (The Association of Chartered Certified Accountants) has announced it will end remote examinations in a bid to curb a sharp rise in academic misconduct.

From March, the global accounting body will require its students to sit assessments in person, effectively ending a practice introduced during the Covid-19 pandemic to facilitate qualification during lockdowns. According to chief executive Helen Brand, the decision was driven by the realisation that safeguards for online invigilation can no longer keep pace with the sophistication of modern cheating methods, particularly those involving artificial intelligence.

The ACCA, which represents over 250,000 members globally, reached a “tipping point” where the integrity of the qualification was at risk. Ms Brand told the Financial Times that while the body worked intensively to secure their systems, students using AI tools – such as photographing questions to feed into chatbots – proved too difficult to police effectively.

This move aligns the ACCA with a broader trend of tightening security, although other bodies like the Institute of Chartered Accountants in England and Wales (ICAEW) still permit some online testing despite acknowledging rising reports of malpractice. The wider profession has faced significant scrutiny recently, with major firms including EY and KPMG paying millions in fines regarding separate internal exam cheating scandals.

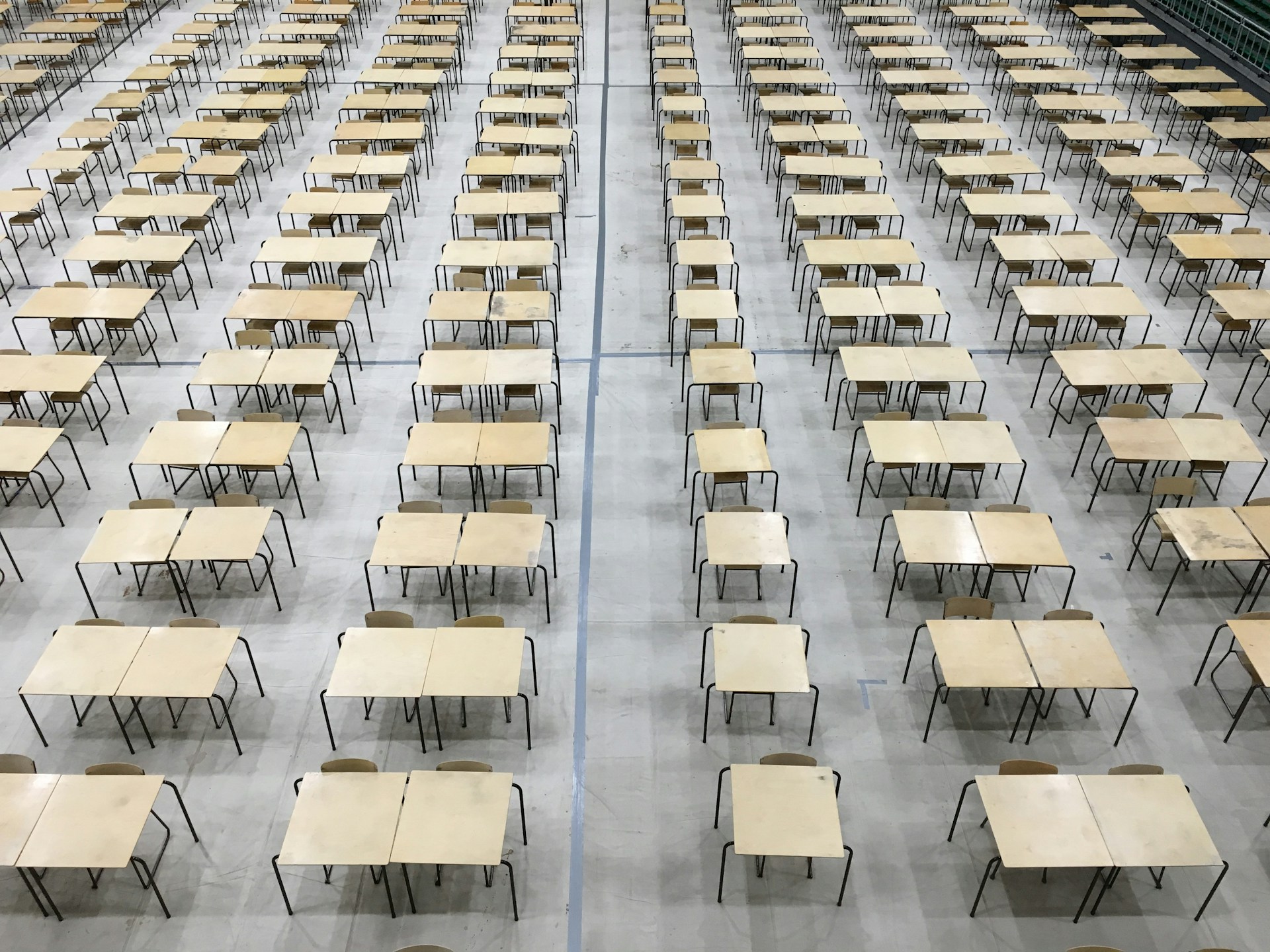

Returning to exam halls represents a significant shift for the ACCA’s 500,000 students. Some have expressed concern regarding the loss of flexibility, citing instances where remote options allowed those with medical conditions or huge travel distances to participate more easily.

As the ACCA removes the digital medium for testing, it is simultaneously overhauling its curriculum to include a heavier focus on artificial intelligence and data science. Ms Brand emphasised that while AI poses a threat to exam security, it has fundamentally shifted the skills required for modern accountants, necessitating new training modules that simulate real-time, dynamic problem-solving.