Growth Capital Ventures leads £1.3m investment into Business Finance Market

Growth Capital Ventures has led a £1.3 million super seed investment round into Business Finance Market (BFM), a fintech platform set to boost access to finance for the country’s 5.9 million SMEs.

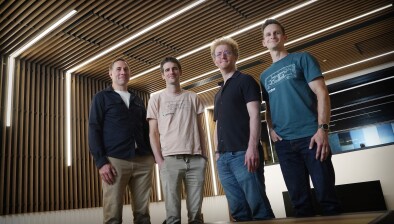

Alison Alden (CFO, Business Finance Market), Craig Iley (founder and CEO, Business Finance Market), Jude Browne (CMO, Business Finance Market), and Craig Peterson (co-founder and COO, Growth Capital Ventures)

The funds will be used to drive the development of BFM’s technology forward and further enhance the team. This round, which saw pledges exceed the initial target of £1m, is further to an oversubscribed seed round of £225,000 in June 2021.

This is the latest EIS-eligible investment opportunity led by Growth Capital Ventures, an FCA authorised investment firm specialising in impact driven co-investment opportunities across alternative asset classes.

Experienced banker and entrepreneur Craig Iley, who has co-founded two challenger banks in the UK, has established BFM to streamline the lending process through technology innovation and a re-engineered customer journey to match lenders and SMEs together to help them secure the right finance for their business. The expert team assembled includes banking specialists, commercial brokers and SME business experts.

With almost 90% of SME loan applications that do not complete due to poor processes, the lending market has become slow, fragmented and in need of innovation. This new technology will allow SMEs to access quicker finance decisions while providing lenders and intermediaries with a fintech platform that will help to manage the end-to-end application process, improve information and increase deal flow in order to deliver faster credit decisions.

Craig Peterson, co-founder and Chief Operating Officer of Growth Capital Ventures, said: “Banking for the SME lending market is notoriously complex, outdated and unsupportive of the needs of the organisations that account for three-fifths of employment and 50% of revenue in the private sector.

“Once developed, this platform will make it easier for SMEs and their trusted advisors to access finance quicker and easier. It will allow businesses to deal with multiple providers at the click of a button. This is an attractive proposition not just for SMEs but banks, commercial brokers, UK plc and the Bank of England.”

In its response to the Van Steenis report, the Bank of England has publicly stated it is keen to champion technology platforms to help SMEs make better use of their data to access services and to apply for and obtain credit using a digital portable credit file.

Craig Iley explained: “SMEs are the backbone of the UK economy but are gradually being excluded from mainstream banking. In 1988 around 40% of all bank lending went to SMEs. Today that is closer to 4% with an estimated £22bn funding gap to around six million UK SMEs.

“Expectations among SMEs are increasing with a demand for more focused lending products, faster credit decisions, improved funding chances and flexible options regarding collateral requirements. We are reengineering the entire journey, to reduce friction for all stakeholder groups and ensure better customer outcomes along with benefits to investors.”

He added: “Our focus on advanced databases and machine-learning algorithms and end-to-end customer journeys differ from the slower, less accurate, labour-intensive application processes and legacy systems in use today. The platform will have a real competitive advantage leading to the potential of higher profit margins, continued growth opportunities and the agility to respond more quickly and effectively than its competitors.”