Living standards take a hit as the UK enters protracted recession

Yael Selfin

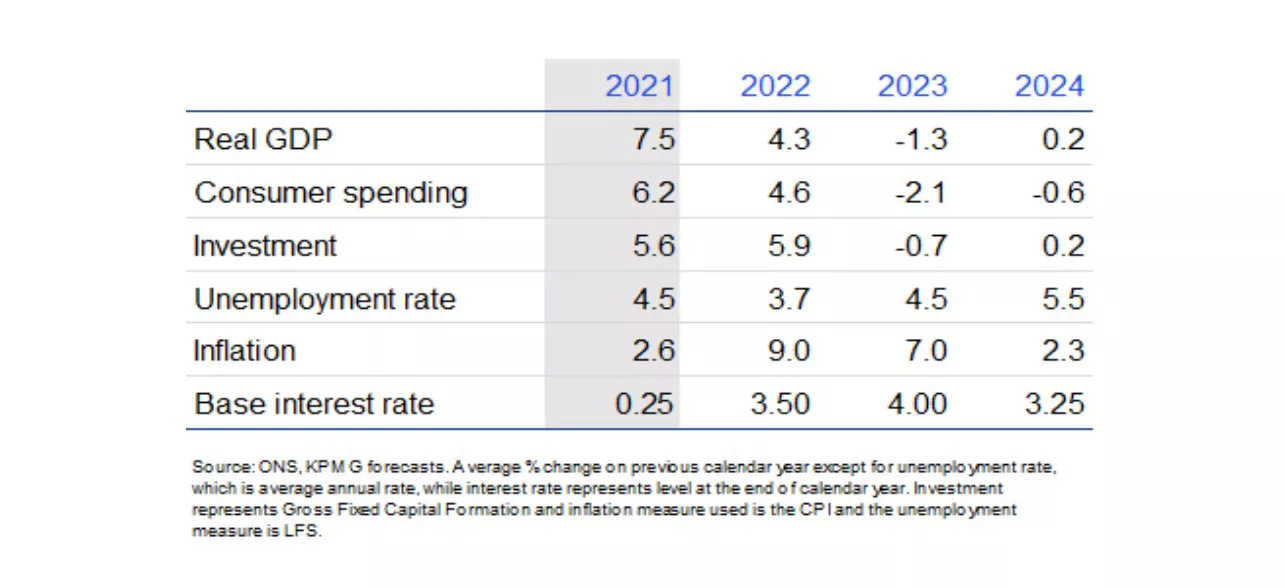

Expert analysis has shown the UK economy will shrink by 1.3% in 2023, amidst a relatively shallow but protracted recession, and will be followed by a partial recovery in 2024, which could see GDP rise by 0.2%.

According to KPMG’s latest UK Economic Outlook, elevated inflation and rising interest rates will continue to put pressure on households’ living standards.

By the end of Q3 2022 household consumption has already fallen by 0.6% on a per capita basis and is projected by KPMG to fall by a further 3.4% by mid-2024. While a fall in savings or higher borrowing could support consumption to some degree, persistently low levels of consumer confidence could lead to higher levels of precautionary savings.

Companies’ margins and investment are negatively affected by rising interest rates and ongoing geopolitical uncertainties, slowing global growth over the medium term. KPMG expect overall investment to shrink by 0.7% in 2023, before recovering by 0.2% in the following year. As the economic environment deteriorates, a higher number of company insolvencies are expected.

Table 1: KPMG forecasts for the UK

Yael Selfin, chief economist at KPMG UK, commented: “The increase in energy and food prices during 2022, as well as higher overall inflation, have significantly reduced households’ purchasing power. Rising interest rates have added another headwind to growth. Lower income households are particularly exposed to the mix of current price pressures, as the most affected spending categories largely fall on necessities, with few substitutes in the short run.

“Households are expected to rein in spending on discretionary items in 2023 in response to the squeeze on income. As consumers cut back on spending, we anticipate a sharp reduction in non-essential categories of spend by those households most affected by the rise in energy and food costs, including spending on eating out and entertainment.”

Outlook for inflation, labour market, housing, and exports

The forecast sees average inflation over 2023 revised to 7.0%, up from 5.6% in its previous report. Inflation is expected to have already peaked in October and to fall gradually over the coming months. The fall in the headline rate partly reflects the dropping out of price increases from the 12-month period that is used to calculate inflation, as well as potential falls in some commodity prices.

The labour market has already begun to cool off, with expectations of lower turnover putting less pressure on employers to recruit, while employees are becoming more cautious to move jobs in light of further uncertainty. With bargaining power pivoting away from employees and towards employers, this could see some moderation in nominal pay growth next year following robust growth in 2022.

KPMG expect the higher interest rates environment to gradually translate into weaker housing market activity, factoring a 8.5% peak-to-trough fall in its forecasts, which reduces both consumer confidence as well as the value of collateral available for homeowners to borrow against in order to finance spending.

The depreciation of the pound may help support export growth, although exports are expected to be affected by weaker demand among UK’s trading partners. Overall export volumes are still some way from their pre-pandemic levels, with the UK performing relatively poorly since the global pandemic. KPMG expect UK exports to rise in 2023 by 4.6% and by 1.1% in 2024.

Ms Selfin, concluded: “The outlook could turn more positive, particularly if energy costs drop back to previous levels. However, risks are probably skewed to the downside, given the state of public finances as well as some companies’ balance sheets, which could make it harder for them to absorb any potential further shocks in the short term.

In addition, a rise in Covid cases during the winter or a further escalation in geopolitical tensions mean that supply chain pressures are likely to remain an issue in the background.”