Lloyds Banking Group to cut office space by 20%

Bank of Scotland owner Lloyds Banking Group is set to cut its space by 20% over the next two years as working from home looks to become a permanent lifestyle change.

Bank of Scotland owner Lloyds Banking Group is set to cut its space by 20% over the next two years as working from home looks to become a permanent lifestyle change.

Lloyds decided to cut its office space after 77% of its 68,000 employees said they wanted to work from home for three or more days a week in the future.

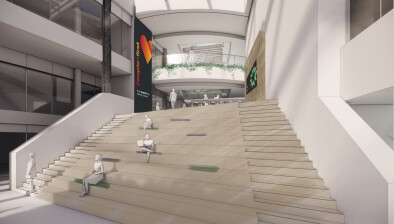

William Chalmers, the bank’s chief financial officer, said Lloyds would make sure offices offered more space for teamwork rather than areas where staff sit at solitary desks.

Yesterday, Scottish Financial News reported that HSBC revealed plans to downsize office space by 40%. Metro Bank has also confirmed it is in the process of cutting its office space by roughly a third.

António Horta-Osório, Lloyds’ chief executive, said hybrid working could attract a broader pool of talent, including younger workers, who want a “better way of combining their personal preferences with their work obligations”.

The news came as the bank announced its profits had dropped to £1.2 billion, down from £4.39bn last year. It also allocated £4.bn to cover future bad loans provided during the COVID-19 crisis.

Lloyds still paid its chief executive £3.4m, however, despite waiving a bonus worth as much as £1.8m. That is his lowest payout since 2012. Horta Osório was paid about £59m during his near-decade-long tenure at Lloyds.

A total of 17 Lloyds bankers earned more than €1m (£860,000) last year, despite staff bonuses having been cancelled in December. Bankers anjoyed a shared bonus pot of £310m in 2019, The Guardian reports.

Lloyds said it would pay each permanent staff member £400 worth of shares that will vest in three years’ time in recognition of their work in the past year.

Mr Chalmers said formal bonuses were likely to restart this year as the economy recovered from the pandemic. He said: “Our performance, unfortunately fell short of our required targets for bonus payouts during the course of 2020. But it’s important to note that we expect that to turn around during the course of 2021… That would be consistent with us resuming bonus payments.”

Lloyds also announced that it was resuming dividend payments, with plans to pay shareholders a combined £404m at 0.57p per share.

The bank has also confirmed that the HSBC banker Charlie Nunn would take over as chief executive on 16 August, three and a half months after Horta-Osório formally steps down on 30 April.

Mr Chalmers will act as chief executive in the interim.