Lloyds has appointed Trusha Pillay as a new managing director in its Infrastructure and Project Finance team. Ms Pillay will focus on expanding Lloyds’ debt advisory and debt structuring business while supporting the bank’s clients across core and emerging infrastructure and power-relate

Lloyds Banking Group

Edinburgh-based renewable energy company, Red Rock Renewables, has reached financial close on a £62m financing with Lloyds, HSBC and China Construction Bank for its Benbrack Onshore Wind Farm. The three lenders have provided equal project financing as the Dumfries & Galloway Project takes

Edinburgh office development, Port Hamilton, is set to undergo a major transformation into a cutting-edge workplace, supported by a £135 million funding package from HSBC UK. Occupied by Bank of Scotland-owner Lloyds Banking Group, the building will be refurbished to the highest sustainability

Ashfield Land has acquired Lloyds Banking Group’s call centre building at Pitreavie Business Park, Dunfermline, with plans to invest in and redevelop the site into a high-quality industrial/logistics development.

Lloyds Banking Group's Emma Noble has joined the board of Scottish Financial Enterprise (SFE). Ms Noble, group director of conduct, compliance and operational risk (CCOR) at Lloyds, replaces Jackie Leiper, who stepped down from the board at the end of 2025.

Lloyds Banking Group has announced a fresh £1.8 billion share buyback after a robust performance in the 2025 financial year, where pre-tax profits jumped 12% to £6.7bn. The banking giant surpassed internal expectations of £6.4bn, demonstrating resilience despite the Bank of England

Lloyds Banking Group, owner of Bank of Scotland and Scottish Widows, has appointed Emma Noble as chair of its Scottish Executive Committee and new group ambassador for Scotland. In her new role, Ms Noble will focus on supporting Scotland’s sustainable economic growth and on improving investmen

The Bank of Scotland has been fined £160,000 by the UK’s sanctions regulator for facilitating transactions that breached financial sanctions imposed on Russia. The Office of Financial Sanctions Implementation (OFSI) penalized the bank after it was found to have processed payments for a d

Scottish Widows has begun trialing new AI software which will enhance its advertising output, and ensure transparency and clarity for customers. The insurance, pensions and investments firm, which is part of Lloyds Banking Group, has just launched a six-month pilot with leading FinProm platform Adcl

Liz Ziegler Around £2 million pounds in card chargebacks have been claimed back by Lloyds customers following a rise in dodgy websites, according to the latest data from the bank.

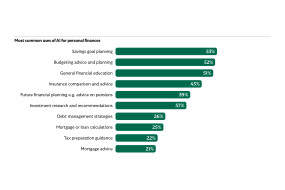

More than 28 million UK adults are now turning to artificial intelligence to help manage their money – making personal finance the nation’s number one use of AI.

Lloyds Banking Group has reported a sharp fall in third-quarter profits after setting aside a substantial provision to cover potential costs from a probe into motor finance commissions. Pre-tax profit for the third quarter fell by 36% to £1.17 billion, though this surpassed analyst expectation

Lloyds has appointed Tony Hable as its new head of infrastructure & project finance. He will lead Lloyds’ infrastructure & project finance business and report to James Ranger, managing director & head of debt solutions.

Bank of Scotland-owner Lloyds Banking Group has announced it will close a further 13 Scottish branches. The closures, part of a broader 49 closures across the UK, are scheduled to take place between January and October 2026.

Bank of Scotland-owner Lloyds Banking Group has reported a significant rise in second-quarter profits, surpassing analyst expectations and leading to a substantial increase in its shareholder dividend. The bank's underlying profit before impairments reached £2.16bn, a 17% increase from the fir