Maximised JISAs reach post-pandemic high, as more families look to pass down wealth sooner

Adrian Murphy

The number of Junior ISA (JISA) accounts that received the full £9,000 subscription rose to a post-pandemic high during the 2023/2024 tax year – the most recent year data is available for – as families accelerated their gifting to children.

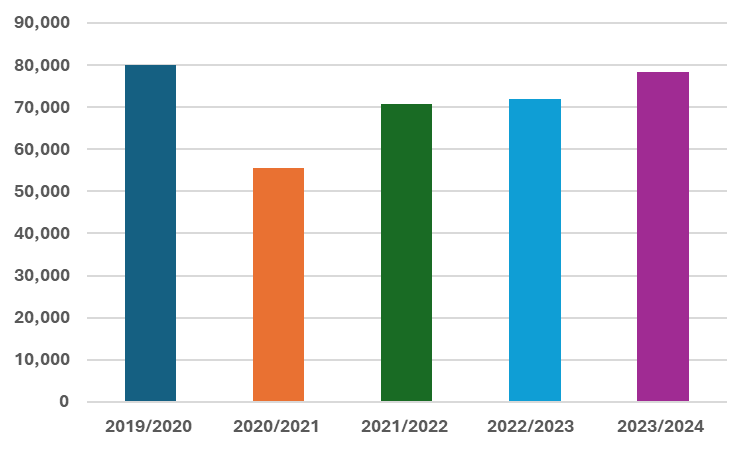

Figures obtained by Murphy Wealth from HMRC through freedom of information revealed that 78,330 accounts maximised their allowance – the most since 2019/2020’s 80,060. It also marks a 9% increase on the previous tax year (up 6,420) and a 41% rise since 2020/2021.

Table 1: Number of JISA accounts maximising their allowance by tax year

| Tax Year | Number of accounts |

| 2019/2020 | 80,060 |

| 2020/2021 | 55,570 |

| 2021/2022 | 70,660 |

| 2022/2023 | 71,910 |

| 2023/2024 | 78,330 |

Separate figures from HMRC show there were around 1.37 million JISAs subscribed to in the 2023/2024 tax year, meaning nearly 6% of the total maximised their allowance. That was in line with the previous year, when 71,910 of the 1.25 million accounts were filled with the £9,000 allowance.

Figure 1: Number of JISA accounts maximised by tax year (source: Murphy Wealth, HMRC)

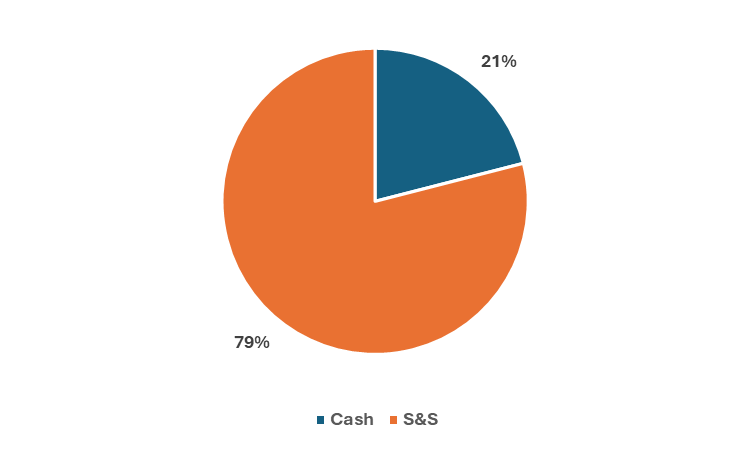

Of the 78,330 JISAs that received the maximum amount during 2023/2024, 61,881 were stocks and shares accounts and the remaining 16,461 were cash. That means nearly 80% of the maximised accounts for the year were invested in stocks and shares.

Table 2: Maximised JISA accounts split by account type for 2023/2024

| Type | Number of accounts |

| Cash | 16,451 |

| S&S | 61,881 |

This was also reflected in the general picture for JISAs. A total of £1.8 billion was subscribed to JISAs in 2023/2024, only around 36% of which was cash. The average subscription also increased to £1,347, a rise of 10% on 2022/2023.

By contrast, regular ISA accounts saw £69.5 billion of cash subscriptions and £31.1 billion invested in stocks and shares, meaning nearly 70% of the total money placed in these accounts was cash. Two-thirds – 66% – of ISA accounts were cash during 2023/2024, with just 27% stocks and shares.

Figure 2: Maximised JISA accounts split by type for 2023/2024 (source: Murphy Wealth, HMRC)

Adrian Murphy, CEO of Murphy Wealth, said: “A lot of families are exploring different ways of passing down wealth to their loved ones earlier in life. JISAs are a great way of doing that, providing tax-free growth and income that can compound over a significant period of time.

“Children can’t access the accounts until they are 18, which also provides a level of assurance that the money will be used for some of the big life events that take place around that age - whether it’s buying a first car, help with university costs, or taking that first step into a career or onto the property ladder.

“And the people making the contributions will likely get to see their child or grandchild enjoy that money, which may not be the case with other ways of tax-efficiently passing wealth down, like Junior SIPPs - these also have a much lower annual contribution limit at £2,880.”

Mr Murphy continued: “On the one hand, it’s encouraging to see so much of the subscriptions being made to JISAs being invested rather than saved as cash. Study after study shows that, over the long term, stocks and shares tend to outperform cash in a significant way.

“The fact that nearly 80% of maximised subscriptions – and 64% more generally – are invested can only be a good thing for passing wealth onto the next generation.

“But the flip side of that is the big difference with how adults save for themselves. Far too much of the money being subscribed to regular ISA accounts is held in cash. Obviously it depends on your circumstances and what stage you are at in life, but many more people would benefit from investing their savings – particularly in their 20s, 30s, and 40s – given the superior returns that you can expect.”

Mr Murphy concluded: “With pensions becoming part of people’s estates from next year – the decision about which wouldn’t be reflected in these figures, as it was announced in the Autumn 2024 Budget – we would expect to see a further acceleration in the number of JISAs being maximised.

“However you plan to pass wealth onto family members, it’s important you have a plan and don’t leave yourself short. Speak to a financial adviser who can provide guidance on how to sustainably gift money to children and grandchildren, while ensuring your financial requirements are taken care of in retirement.”