Over 28 million adults now using AI tools to help manage their money

More than 28 million UK adults are now turning to artificial intelligence to help manage their money – making personal finance the nation’s number one use of AI.

Lloyds Banking Group’s latest Consumer Digital Index is the UK’s largest study of digital and financial capability, now in its 10th year.

The research reveals that artificial intelligence has rapidly become a financial tool for millions across the UK, with 56% of adults – around 28.8 million people – saying they’ve used AI in the past 12 months to help manage their money. Among them, ChatGPT is referenced as the most popular platform, used by six in 10.

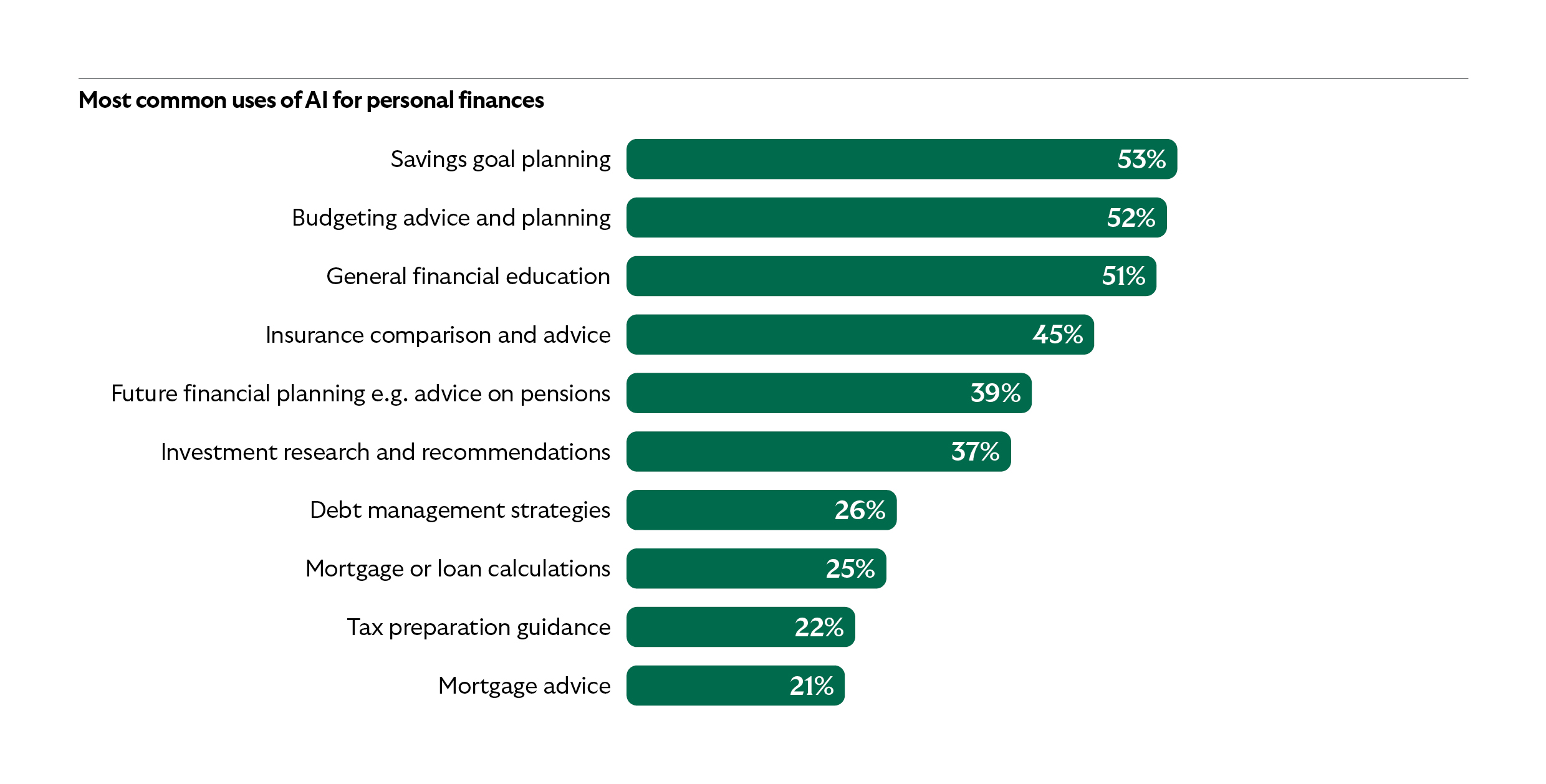

With more than half of people who use AI employing it for budgeting, savings planning, or general financial education, it’s now a go-to resource.

More than a third of users (37%) say they engage with AI for investment research and recommendations, a quarter (26%) for debt management strategies, while almost four in 10 (39%) have turned to it for future financial planning, such as information on pensions.

One in three people report using AI once a week or more to help with money matters – more than those using it for health advice, shopping recommendations, travel planning or recipe ideas.

The research highlights how can AI empower people to make smarter choices, save more, and build financial resilience for the future.

For example, users estimate they’ve saved an average of £399 per year thanks to AI-generated insights.

Over the past decade, Lloyds Banking Group’s Consumer Digital Index has tracked the UK’s shift to digital-first living and the link between digital confidence and financial wellbeing.

Today, almost nine in 10 people (87%) now feel confident using the internet – a rise of more than four million people in just five years.

In the last 10 years, Lloyds has seen the number of customers using its mobile banking apps rise more than three-fold to over 21 million.

Digital activity isn’t just a habit - it’s a gateway to financial empowerment. People who use digital tools regularly are significantly more likely to feel engaged and confident in managing their finances. Two-thirds (66%) of internet users say being online makes them feel more confident managing money.

And 93% of those that say they feel confident using digital tools to manage their finances report feeling knowledgeable enough to make informed decisions about their finances, compared to 62% of those lacking confidence.

Among confident internet users, 98% say being online has saved them time or money. And for those not yet online, one in three believe better digital skills would help them take greater control of their finances, highlighting the power of digital inclusion.

Those with high digital capability are nearly two times less likely to lose sleep over money worries, or to feel stressed or overwhelmed when thinking about their finances, compared to those with lower digital capability.

Despite its growing popularity, trust in AI still lags behind usage. 83% of AI users say they worry about data privacy, while 80% are concerned about receiving inaccurate or outdated information. Nearly seven in 10 (69%) are worried about a lack or personalisation based on their personal circumstances.

This trust gap highlights a critical challenge: while millions are willing to experiment with AI-driven tools, most remain reluctant to rely on them without validation from more established sources and the regulatory oversight that financial matters demand.

With more than one in three adults expecting to increase their use of AI for money management in the next year, combining the cutting-edge technology with trusted expertise will be key to building confidence and unlocking its full potential.

Jas Singh, CEO consumer relationships at Lloyds Banking Group, commented: “AI is rapidly transforming how people manage their money, with the potential for millions of consumers to feel more confident and in control of their personal finances. From everyday budgeting to planning for the future, we’re already seeing people use the technology to make smarter choices and build financial resilience.

“But as AI becomes a bigger part of our financial lives, trust is the next frontier. People want to be sure the information they receive is accurate, secure and truly tailored to their needs. That’s why banks have a vital role – not just in providing cutting-edge technology, but in combining it with trusted expertise and a deep understanding of our customers.

“As we continue to innovate, our focus is on building tools people can genuinely rely on – helping everyone to benefit from the confidence and clarity that digital solutions bring.”