Scottish company insolvencies up 9% in February 2024

Michelle Elliot

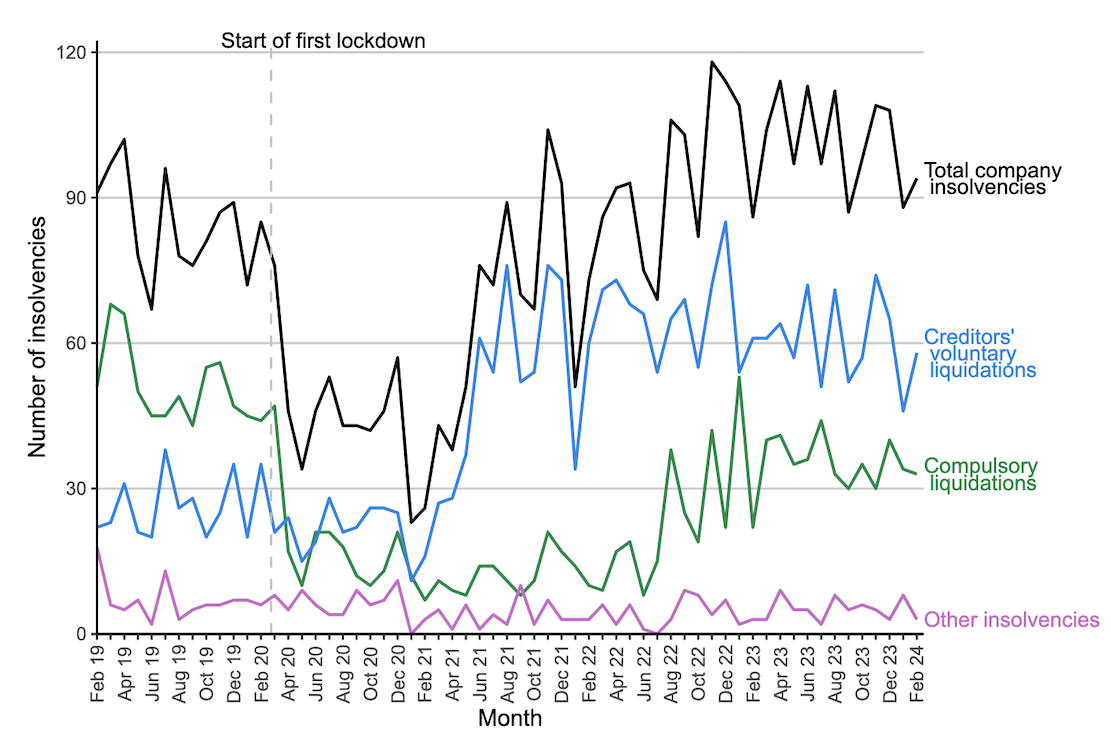

Company insolvencies in Scotland rose by 9% during February compared to the previous year, totalling 94 cases, according to data from the Insolvency Service.

This comprised 33 compulsory liquidations, 58 creditors’ voluntary liquidations (CVLs), and three administrations, with no company voluntary arrangements (CVAs) or receivership appointments.

Company insolvencies in Scotland from February 2019 to February 2024, not seasonally adjusted (source: Insolvency Service)

Michelle Elliot, restructuring advisory partner at FRP in Glasgow, commented: “After last month’s dip in insolvency levels, numbers are rising once again.

“Indeed, the long-term picture is that firms burdened by debt or who were deeply impacted by the effects of the pandemic are struggling to re-establish a foothold in the face of persistently weak consumer demand and high interest rates.

“Instead of fresh starts, April’s new tax year will bring a new hurdle for Scottish businesses in the form of a rise in the National Living Wage, which will increase every firm’s wage bill.”

She continued: While borrowing and trading conditions will eventually improve as inflation eases, conditions are still likely to be challenging for some time to come.

“Companies will need to remain vigilant when it comes to their financial health, plan to address any particular pressure points – known and unknown – and be ready to take quick, proactive action at the first sign of difficulty. In our experience, early action always leads to the best results.”