Scottish people saving for holidays, not homes

Scottish people are more likely to be saving for a holiday than for a home, RBS’s Savings Index has revealed.

The index has indicated that savers in Scotland are more likely to be saving to go on holiday than other savers across Britain.

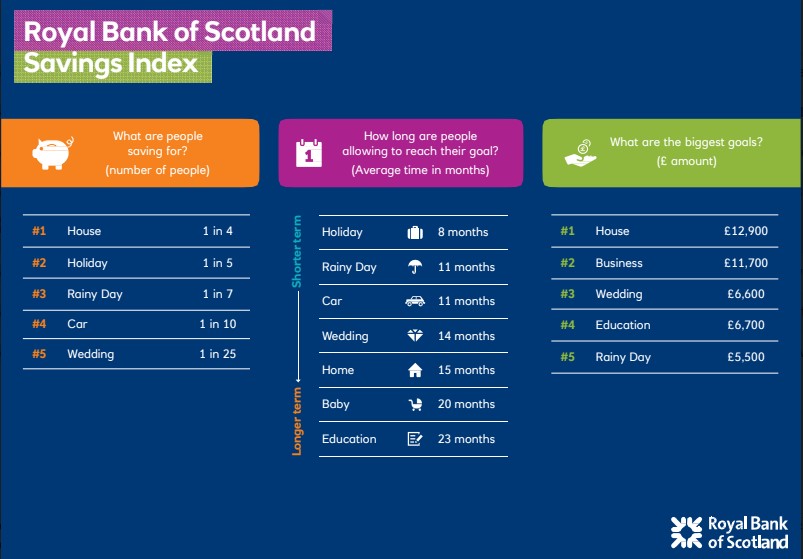

It also revealed that one in four Scottish people set a goal of saving towards a holiday, making it the most popular money-saving goal in Scotland. Across the rest of the UK overall, one in five people are saving for a holiday, with an average goal of £2,700 over an eight-month time period. However, in London, only one in six savers are looking to save to go abroad.

The top savings goal in the UK is saving towards buying a property. Nearly one in four people set a target to save nearly £1,000 a month, as the average target £13,100 over 15 months. The most popular goal within Southern England is to buy a home. The index has shown that just over one in seven are saving for a rainy day, setting a target of £5,500 over 11 months.

Head of savings, Royal Bank, Allan Hardie, said: “Our Savings Goal tool is proving extremely popular. It’s designed to help customers save more and achieve their goals. Simply setting a goal helps to develop a savings habit and leads to customers saving twice as much as those without a goal.”

CEO of the Fairbanking Foundation, David Coe, said: “Mobile Banking makes saving easier than ever because you can create a goal, set up automatic monthly saving and track progress in just a few clicks. We welcome Royal Bank of Scotland’s Savings Index which along with these easy to use tools will further focus people’s attention on saving for the things they want in life.”

Savings expert, Single Financial Guidance Body, Michael Royce, said: “We welcome the encouraging news that so many people are planning for big purchases through savings goals – and that those setting rainy day goals are saving more on average. We would encourage more people to get into the habit of building emergency savings to help with the costs of unexpected events.”