UK households pay more for less compared to advanced economies

Housing stock across the UK is characterised as “expensive, cramped and ageing” when compared with that of other countries, according to new analysis by the Resolution Foundation.

The foundation’s latest Housing Outlook uses OCED data, which compares housing metrics across advanced economies. It reveals that UK households are paying substantially more for inferior quality housing, making the UK’s housing stock the worst value for money among developed nations.

The report notes that the share of household income spent on housing is the most common way to assess housing costs. However, such a measure is less useful for international comparisons as it is affected by a country’s share of outright owners, who don’t have ongoing housing costs. For example, Italy, Spain and the UK (61%, 49% and 36% respectively) have a far greater share of outright owners than Germany and the Netherlands (26% and 9% respectively).

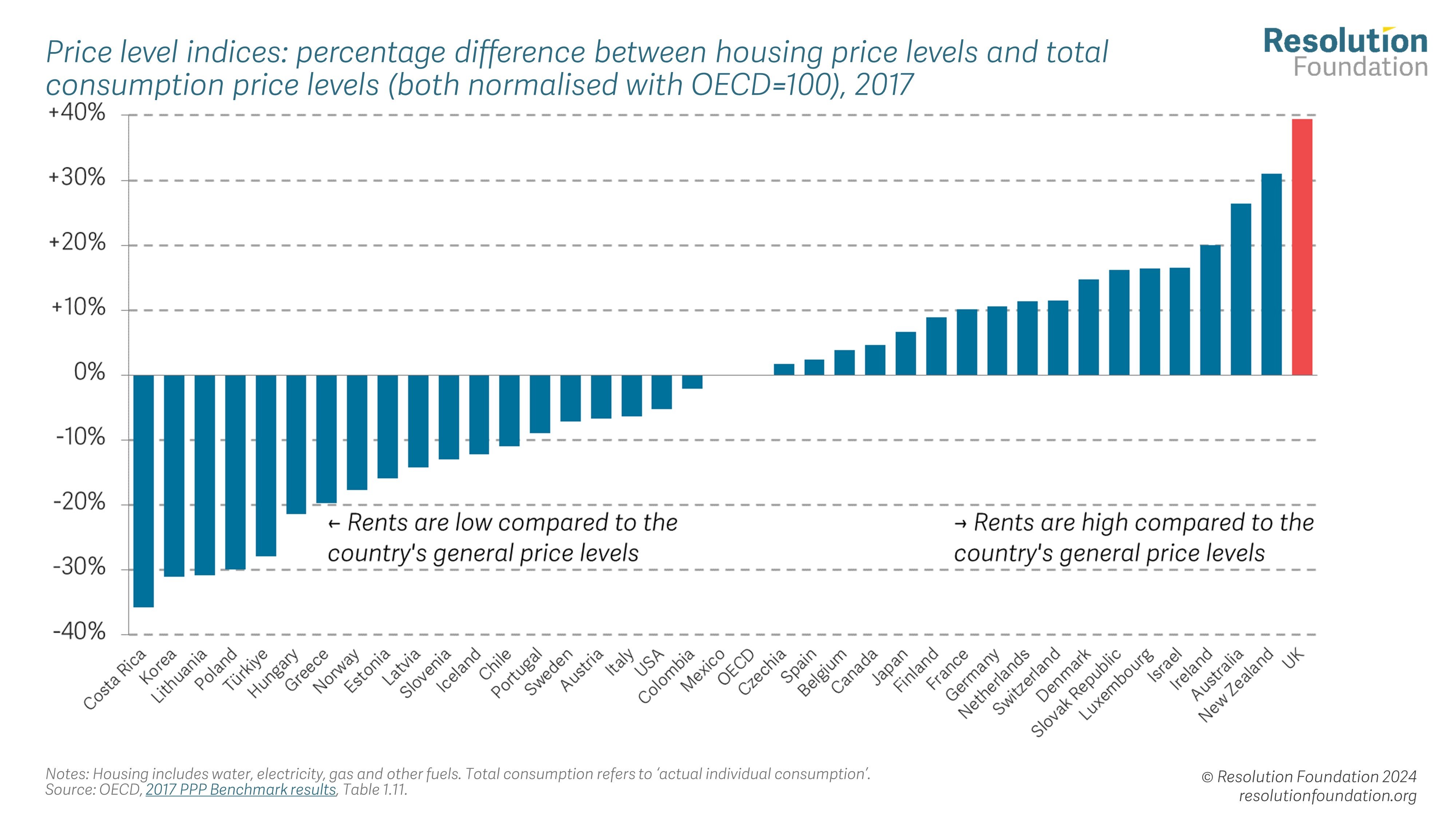

To make an international comparison of the actual market cost of housing, the analysis examines what it would cost to rent all homes – incorporating the imputed rents, or what owners would pay if they rented their home at market rates – to show how the market price of housing varies across a range of countries. It finds that housing represents a greater share of consumption on this basis in the UK than in any other advanced economy bar Finland.

In theory, these high housing costs could reflect the cost of a superior quantity or quality of housing in the UK, but in reality they do not. People instead pay more and get less. The report shows that English homes actually have less average floorspace per person (38 metres squared) than many similar countries, including the US (66m sq), Germany (46m sq), France (43m sq) and even Japan (40m sq).

Incredibly, English homes have less floor space, on average, than homes in the notoriously cheek-by-jowl New York City (43m sq). Overall Brits get 24% less housing per person than Austrians and 22% less than Canadians, both of whom have similar consumption levels overall.

As well as being cramped, the UK’s housing stock is also the oldest of any of European countries, with a greater share of homes built before 1946 (38%) than anywhere else. For example, just 21% of homes in Italy, and 11% in Spain, were built before the end of the war. Older homes tend to be poorly insulated, leading to higher energy bills and a higher risk of damp, says the foundation.

The foundation concludes that high cost and low quantity leave the UK’s housing stock offering the worst value for money of any advanced economy. UK households pay 57% more for the same (quality-adjusted) housing as their counterparts in Austria, for example, and 36% more than those in Canada. Housing in New Zealand offers the second worst value for money, followed by Australia and Ireland – all countries also gripped by housing crises.

Adam Corlett

Adam Corlett, principal economist at the Resolution Foundation, said: “Britain’s housing crisis is likely to be a big topic in the election campaign, as parties debate how to address the problems of high costs, poor quality and low security that face so many households.

“Britain is one of many countries apparently in the midst of a housing crisis, and it can be difficult to separate rhetoric from reality. But by looking at housing costs, floorspace and wider issues of quality, we find that the UK’s expensive, cramped and ageing housing stock offers the worst value for money of any advanced economy.

“Britain’s housing crisis is decades in the making, with successive governments failing to build enough new homes and modernise our existing stock. That now has to change.”