Experian: AAB leads the field in Scottish M&A activity

In its latest review for the third quarter Experian reported a notable downturn in M&A activity across Scotland, with deals totalling £4.9 billion in value, marking the fourth consecutive period of decline.

In Experian’s latest United Kingdom and Republic of Ireland M&A Review, only 73 deals were observed during Q3 2023, marking the lowest for a Q3 since 2020. This brings the year-to-date total to 265 deals, a reduction of just under 25% from the previous year. The £4.9bn cumulative value of these deals is a 67% decrease from the prior period.

The financial adviser rankings for deals by volume shows that the top three firms held their position from the previous quarter. Having taken part in 13 deals, AAB (Anderson Anderson & Brown) came in first. It was closely followed by Grant Thornton with 12 deals, and Azets kept its third place with 11 deals.

K3 Capital Group and HNH Partners move up to fourth and sixth position from joint 15th, with nine and seven deals respectively. RSM held its placement at number five with eight deals.

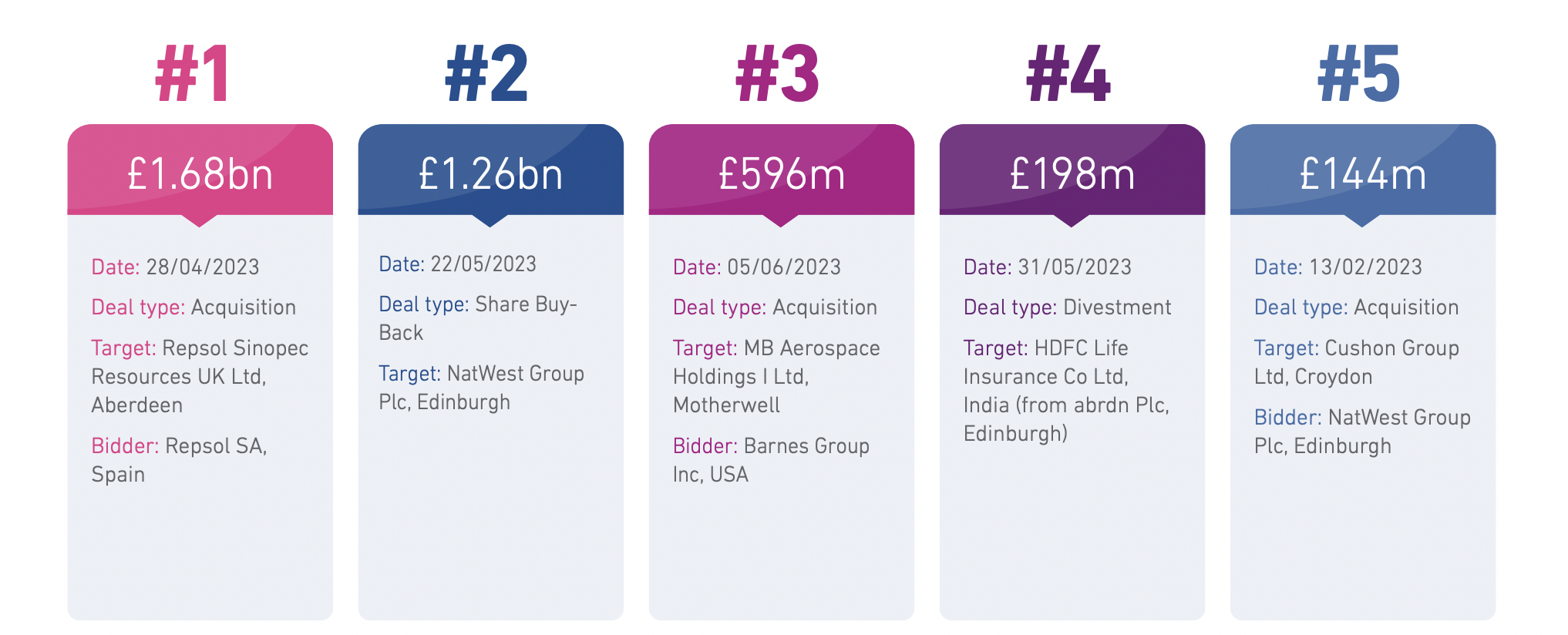

Top five deals in Scotland for Q3 2023 (source)

Johnston Carmichael placed seventh with six deals, having dropped from fourth position. Cortus Advisory, a new entrant to the rankings, came in at eighth. BDO held ninth rank with 5 deals, and PwC moved up two ranks to tenth.

The resilience of smaller cap and mid-market deals was apparent despite the overall downturn. While the volume of these deals declined by an average of 23%, the valuations of mid-market deals were down by a mere 11%, and small-cap deals saw a 25% drop. However, the upper end of the market faced a more pronounced decrease, with deal volumes and values falling by 50% and 69%, respectively, influenced by challenging trading conditions and market volatility.

The majority of corporate activity comprised acquisitions and growth capital deals, with the former accounting for 63% of the total volume and the latter 22%. Interestingly, the employee-owned business model has doubled in popularity, as reflected in a 100% increase in such deals year on year. Conversely, private equity investments saw a decline of over 30%, indicative of prevailing investor caution. This caution also extended to the capital markets, with a 70% reduction in equity capital market (ECM) deals and a complete absence of initial public offerings (IPOs).

Overall, Scotland’s M&A activities constituted 5.9% of the UK’s total by volume and 3.6% by value.