FSB calls for Scottish Budget to protect small firms from business rates nightmare

Guy Hink – FSB Scotland chair

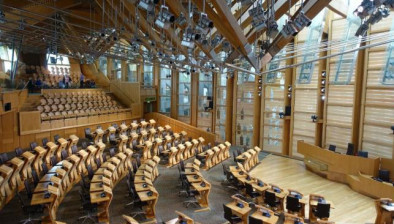

The Federation of Small Businesses (FSB) has urged the Scottish Government to use January’s Scottish Budget to protect small businesses facing significant non-domestic rates rises.

Some of the stalwarts of local high streets, including independent pubs and post offices, are facing huge rates rises in April as a result of the latest revaluation of their properties. Small accommodation providers across the country have also received draft notices which would see their rates bills soar by up to 400%.

In a letter to Public Finance Minister, Ivan McKee, FSB is calling on the Scottish Government to introduce measures in its forthcoming Budget to ensure small businesses are protected from a significant tax increase on top of existing cost pressures.

Guy Hinks, FSB Scotland chair, said: “The prospect of dramatic increases in their business rates couldn’t come at a worse time for small businesses when economic conditions are already extremely challenging. That is why it is so important the Scottish Government uses the opportunity presented in its Budget in January to protect hard-pressed small businesses.

“Ever increasing costs, combined with turnovers that are now falling, means profitability is being squeezed out of local businesses. The last thing they need is the rates revaluation turning into another costs nightmare in April.

“Any boost those in the retail, hospitality and leisure sectors may have been hoping for during the so-called “golden quarter” in the run-up to Christmas could be wiped out by the looming increase in their rates bill come the spring.

“We are asking the Scottish Government to take sensible steps to protect many otherwise robust businesses. They have options at their disposal. Taking action now means they are more likely to be able to weather the current economic storm and come out the other side in a position to continue serving local communities and supporting local jobs.”

FSB has reiterated its call for the Scottish Government to reduce the multiplier used to calculate final rates bills. The results of the draft 2026 revaluation mean that freezing the multiplier as in previous years may no longer be enough to mitigate the extent to which rates bills will increase next year, it said.

Mr Hinks added: “Given the scale of some of the increases to rateable values we are seeing, we are concerned that even a freeze will mean the Scottish Government’s commitment to keep 100,000 businesses out of non-domestic rates altogether will be eroded even further.

“That’s why we’re also calling for the introduction of a new, reduced multiplier for those businesses in the retail, hospitality and leisure sectors, mirroring actions taken in England and Wales.”

With a significant proportion of small businesses facing increases to their rateable values, this may mean they lose the rates relief they receive through the Small Business Bonus Scheme (SBBS).

FSB is therefore calling on the Scottish Government to use January’s Budget to restore the thresholds for SBBS relief to at least the levels they were set at before they were reduced in 2023. At the absolute minimum, transitional relief for those impacted by the most significant RV increases is essential, it added.