Scotland’s IHT bill to near £400m by 2026/27

Roddy Harrison – Private client partner at Wright, Johnston & Mackenzie

The number of families estates in Edinburgh and Glasgow subject to Inheritance Tax (IHT) is set to rise sharply by the end of 2026/27, according to a new report by Wright, Johnston & Mackenzie and Irwin Mitchell.

The findings are based on a Freedom of Information request to HMRC and form part of a wider analysis covering 177,000 estates across all 121 UK postcode areas.

In Edinburgh, the number of IHT-liable estates is projected to reach around 520 by the end of 2026/27 – up from 296 in 2015/16 – with the city’s total tax liability expected to soar by 180% from £45 million to £126m. The average IHT bill per estate in the capital could hit £239,000 according to the report’s estimates.

Meanwhile, Glasgow is predicted to see a 29% increase in liable estates, rising from 210 in 2015/16 to approximately 270 when 2026/27 ends. The city’s IHT liability is forecast to more than double, from £32m to £69m. The average IHT bill per estate in Glasgow could reach £253,000 – higher than the Scottish average of £211,000.

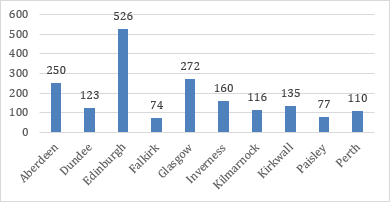

Across Scotland, the total number of IHT-liable estates is projected to reach 1,800 by the end of 2026/27, with a combined tax liability of £389m – approaching the £400m mark.

These figures reflect a broader trend across Scotland, where rising property values and frozen thresholds are pushing more families into the IHT net.

Predicted number of IHT liable estates in Scotland in 2026/27 (credit: Wright, Johnston & Mackenzie and Irwin Mitchell)

Roddy Harrison, private client partner at Wright, Johnston & Mackenzie in Edinburgh, said: “These figures show that families in Edinburgh and Glasgow are increasingly being drawn into the inheritance tax net. With liabilities rising sharply and average bills now well above the Scottish average, it’s vital that individuals seek tailored advice.

“At Wright, Johnston & Mackenzie we’re helping more clients navigate these changes and protect their estates for future generations.”

From April 6, 2026, significant reforms to Agricultural Property Relief (APR) and Business Property Relief (BPR) will take effect, capping full 100% relief at £1m for combined qualifying assets, with amounts above this threshold receiving only 50% relief. AIM-listed shares will also see reduced BPR eligibility.

The Office for Budget Responsibility estimates that 130 estates will be affected by APR changes and 1,440 by BPR, generating an additional £200m in tax revenue in 2026/27.