The British Business Bank’s Investment Fund for Scotland has agreed £5 million of deals to support the growth of small businesses, just six months since the fund was launched to improve access to finance and provide a boost to the Scottish economy. The milestone comes as five new debt fu

British Business Bank

Film and photography start-up OJE Studios is expanding its headcount and relocating operations to Edinburgh after a funding boost from the British Business Bank’s Start Up Loans scheme. Founded by 19-year-old Omar Etherington-Brown, the studio offers a range of services including film and musi

Mark Sterritt, director at the British Business Bank, discusses the organisation's £150 million Investment Fund for Scotland, and its aim to provide financing options for small businesses and entrepreneurs across Scotland in an effort to address regional imbalances in access to capital. A

The Wine Hall, a Perth-based e-commerce platform specialising in rare wines, has broadened its product range and begun targeting new markets following funding from the Start Up Loans programme. Founded in 2022 by 51-year-old Vanessa Tortella, a sommelier from Italy, The Wine Hall sells a range of ra

Equity investment in Scotland’s smaller businesses nearly halved last year but was still ahead of the UK average and on track to record the third highest annual figure in the last decade, according to new research from the British Business Bank. The Bank’s Small Business Finance Markets

Kedras Clinics, a neurotechnology-focused wellbeing therapy provider, has successfully secured a £50,000 loan from the British Business Bank's Investment Fund for Scotland, Smaller Loans fund. Delivered through DSL Business Finance, the loan has empowered Kedras Clinics to open a second locati

The British Business Bank has made its first major deal from the £150 million Investment Fund for Scotland, with a £750,000 equity investment, through appointed fund managers Maven Capital Partners into medical technology business Carcinotech. Edinburgh-based Carcinotech has raised &poun

Edinburgh-based fashion designer Eilidh Gibson, a Glasgow School of Art graduate, has successfully launched her first collection, Party Pants, following a significant financial boost from the Start Up Loans programme.

Massimo Panarella, the entrepreneur behind Kirkcaldy-based Don Basilico, has successfully garnered a £25,000 loan to purchase a new food truck, enhancing his authentic Italian pizza offering in Fife.

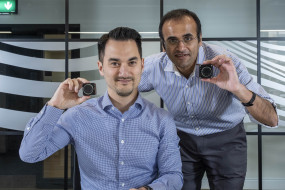

Advanced space camera technology firm Metahelios has been named as one of the 12 new ambassadors for the Start Up Loans programme, an initiative of the British Business Bank. The programme has delivered more than £63 million of loans to 6,900 Scottish start-ups, at an average value of £9

Edinburgh and its surrounding area has emerged as the UK’s top innovation-led cluster for equity deals outside of the ‘Golden Triangle’ of Greater London, Oxford, and Cambridge, according to a new report launched today by the British Business Bank. The Bank’s Nations and Regi

The British Business Bank has unveiled its new £150 million Investment Fund for Scotland, unlocking additional funding to help smaller businesses to prosper and thrive.

The British Business Bank (BBB) reported a £135 million post-tax loss in its latest financial year, predominantly due to a dip in tech company valuations. The bank experienced a £146m loss on its investment portfolio in the year to March, contrasted with a £619m gain in the precedi

Delivering over 105,000 loans, the British Business Bank's Start Up Loans programme has passed a significant milestone having disbursed more than £1 billion in loans. Scotland has seen a substantial slice of this pie, with more than £62 million funded across almost 7,000 loans since 2012

Susan Nightingale discusses the gender disparity in funding for entrepreneurs in Scotland and outlines various initiatives and strategies aimed at closing this gap, including the role of female angel investors and partnerships with organisations like Mint Ventures. Equality, diversity and inclusion