The dramatic surge in claims for mis-sold PPI before last week’s deadline has led RBS to allocate between £600-£900 million to cover the costs.

Rbs

Residents of Fort Augustus worry that their town is facing a crime wave because bank closures mean businesses must keep cash on their premises.

Royal Bank of Scotland has provided a £410,000 funding package to allow an Islay to expand its offering with additional rooms and a new bar and restaurant.

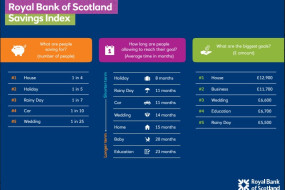

Scottish people are more likely to be saving for a holiday than for a home, RBS's Savings Index has revealed.

RBS has provided a £1.4 million funding package to private landowner Richard Tuxford to aid the purchase of the 9,800-acre East Glenquoich Estate in the West Highlands. The deal was advised and brokered by Royal Bank of Scotland broker development manager, Steven Darbyshire and Independent Ban

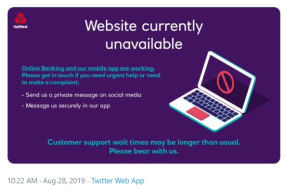

Royal Bank of Scotland (RBS) and NatWest are suffering their second IT outage in one week, with online services failing early Tuesday morning.

Royal Bank of Scotland has been ordered by the Competition and Markets Authority (CMA) to appoint an independent body to audit its payment protection insurance (PPI) processes. The watchdog announced action against RBS and Santander over failures to comply with a requirement that customers receive a

Royal Bank of Scotland (RBS) has financially supported Perth-based company J&S McKenzie's purchase of Moness Resort and Aberfeldy Caravan Park. RBS has provided the family-run business with a seven-figure funding package to help them to make the purchase.

An IT glitch at the Royal Bank of Scotland (RBS) has prevented its credit card customers from accessing their accounts and paying off outstanding balances.

Royal Bank of Scotland (RBS) and Scottish Ethnic Minorities Lawyers Association (SEMLA) are hosting their first networking event for Black, Asian and Minority Ethnic professionals working in Scotland. The event is to take place in Edinburgh on September 5 at the bank's historical home of St Andrews

The Information Commissioner's Office (ICO) has provided advice to Royal Bank of Scotland in relation to a historic data breach affecting over 1,600 NatWest customers, according to reports. The data breach, which relates to files left in a former NatWest employee's home for over a decade after she l

An alliance of business owners has called for a £1 billion Royal Bank of Scotland dividend to be used to help fund the planned Business Banking Resolution Service. The alternative dispute resolution service is being set up later this year by seven major banks and small business representatives

Revised plans are in the pipeline for a new neighbourhood on the site of the former Royal Bank of Scotland offices in Edinburgh’s New Town. Real estate firm Orion Capital, the new owner of the building and the 5.9-acre site in Dundas Street, is working with property company Ediston on a planni

Royal Bank of Scotland is bringing its new initiative to support female entrepreneurship across Scotland to Edinburgh next week. The bank has developed a crowdfunding programme called "Back Her Business" in partnership with established provider Crowdfunder, as part of its wider ambition to reduce th

Former RBS executive Jim Brown has been appointed CEO of Sainsbury's Bank, subject to regulatory approval. Mr Brown will join as CEO designate next Wednesday and will work with outgoing CEO Peter Griffiths for a short handover period.