Scotland's most inspiring entrepreneurs have been recognised at the Great British Entrepreneur Awards 2021: The Finals. In partnership with Starling Bank, the ceremony was held at Grosvenor House and saw 159 businesspeople recognised for their achievements, including 17 from across Scotland.

News

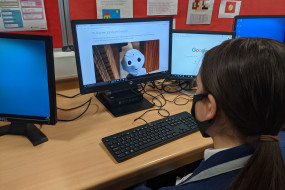

Deloitte has launched an app and education programme for S1 and S2 pupils with Innovate Finance.

Professional services firm Accenture has announced plans to boost its UK workforce by 3,000 new roles over the next three years. Edinburgh and Glasgow feature strongly in Accenture’s plans to boost its UK workforce, with further plans to boost its workforce in Newcastle, Manchester a

Edinburgh-based tech firm Amiqus has enabled one of the UK’s most successful vaccine rollouts this year by providing remote pre-employment screening technology used for NHS staff pre-employment checks according to the NHS Business Services Authority (NHSBSA). Amiqus’ platform has been us

Candle Shack, an Edinburgh-based manufacturer and supplier of candle making supplies and equipment for luxury international brands, has announced the appointment of Ton Christiaanse as its first chairman. With an impressive track record, Mr Christiaanse brings a wealth of experience in international

UK Government Minister for Scotland Lord Offord gave opening remarks at the Scottish Financial Enterprise Dover House reception as a new TheCityUK report shows the contribution of the Scottish sector to the UK Government’s ambitions of a ‘high-wage, high-skilled’ economy. The recep

Glasgow-based brand strategy agency Frejz has become the first in Scotland to gain “eco-friendly” accreditation for its website using a new carbon emissions measure. The tool calculates how much CO2 a website generates, and advises that each page view should use less than one gram per pa

Transport Scotland will relocate its headquarters to HFD Group’s 177 Bothwell Street in Glasgow, in a move that will support the organisation’s environmental, social, and governance (ESG) objectives. Scotland’s national transport agency has secured 50,000 sq. ft. across two floors

Clydesdale Bank owner Virgin Money has strengthened its technology expertise, partnering with global invoice financing firm Accelerated Payments to support the development of its business banking proposition and bring additional services to customers.

Nearly a million public sector workers in India have been forced to swear off alcohol for life by their state's prohibitionist leader. Nitish Kumar, chief minister of the northeast state of Bihar, ordered all employees of the state to take a lifelong pledge to steer clear of alcohol, The Times repor

Anderson Anderson & Brown (AAB), the tech-enabled business-critical services group, is building on the existing support it provides to Scotland’s tech sector through a series of innovation hubs and accelerator sponsorships. AAB’s established Tech team is located across AAB’s of

Aberdeen-based Drummond Finance has announced its expansion to Dundee as the firm celebrates its third anniversary. Steve Ayre, an experienced commercial banker, has joined the firm to support existing activities and grow its corporate footprint into Dundee and the surrounding area.

The demand for ‘Green Jobs’ is higher in Scotland than in any other part of the UK, and the country is also best positioned to maximise the benefits of green investment, according to PwC. These findings come from PwC’s Green Jobs Barometer launched today - a first of its kind analy

Specialist employment lawyer Musab Hemsi has joined Anderson Strathern as a director in the Scottish legal firm’s Employment Law team. Mr Hemsi joins from law firm LexLeyton, where he spearheaded the Glasgow team advising across the food and drink, retail, energy, construction, and digital tec

A mortgage offering fixed monthly payments for 40 years was launched last week by Kensington Mortgages.